DEPOSIT

The first thing you need to have before going house shopping is a deposit. A deposit can be anywhere between 5-20% of the value of the property. The reason why it’s not a set amount is because it will vary on the type of property, the contract and bank lending.

The deposit will depend as well if you are eligible at 5% deposit scheme that the Government released in January 2020 where they will grant 10,000 first home buyers will be able to obtain a loan to build a new home or purchase a newly built home with a deposit of as little as 5%.

Overview:

Start Date: 1 January, 2020

Latest Release Date: 6 October 2020

Eligibility: Singles earning less than $125,000, couples less than $200,000

Minimum Deposit Required: 5%

Property Price Cap: Dependent on region and property type (see below)

Administering Body: National Housing Finance and Investment Corporation (NHFIC)

Not all properties will be eligible to be purchased under the government’s home deposit scheme. The scheme will only underwrite loans for ‘entry properties’, excluding high-value properties. An ‘entry property’ has been determined by the government through the price caps, to ensure the scheme is only available for the purchase of a modest home, or the purchase of land and construction of a modest home. There is no fixed maximum value for properties eligible under the scheme, as price caps will be determined relative to the property’s local market and dependent on if you are applying under the new home guarantee scheme or not. You will need to check what the property price cap is in your area.

LENDING

The second thing you need before going shopping either than the deposit is your Finance and Lending approved.

When it comes down to getting money from the bank your best option is to go to an independent broker that works with aggregators and has access to over 40 banks that we don’t even know exist. Walking into your bank branch is not usually the best option. The reason behind it is imagine you want to buy a car within a budget and with specific set of specs. If you walk into a Mercedes dealership or a BMW all they can offer you is their cars. But if you go to a dealership that has all the brands now you can really choose and find what best suits you.

Here is a list of Brokers I use all the time and I know that are really good in looking after their customers.

Now that you have your deposit and lending sorted is time to find a property that will allow you to pay $0 in Stamp Duty (First Home Buyer Assistance Scheme) and possibly give you $10,000.00 of FHBG. Yes!! You read right!

If you are smart enough and understand that your first home will not be your forever home, you can take advantage and buy something that fits the requirements for you to be entitled of the no stamp duty plus the FHBG (First Home Buyer Grant). What are the requirements?

First Home Owner's Grant (New Homes) scheme (FHOG)

This grant scheme only applies to buying or building a new home.

You can make a claim if:

- your home is newly constructed and has a total value of less than $600,000

- the land and the dwelling you intend to build has a combined value of less than $750,000.

Eligibility

To be eligible

- you must be an individual (not a company or trust) and over 18 years old

- you, or at least one person you’re buying with, must be an Australian citizen or permanent resident

- you or your spouse must not have previously:

- owned or co-owned property in Australia

- received a first home owner grant in Australia

You can apply for the FHOG when you arrange finance to buy your home. The bank or financial institution providing you with a loan will need to be an approved FHOG agent.

For you to be able to buy a property and not pay stamp duty you will need to buy a property that is eligible to the First Home Buyer Assistance Scheme you can read all about it here on this link or see below the summary.

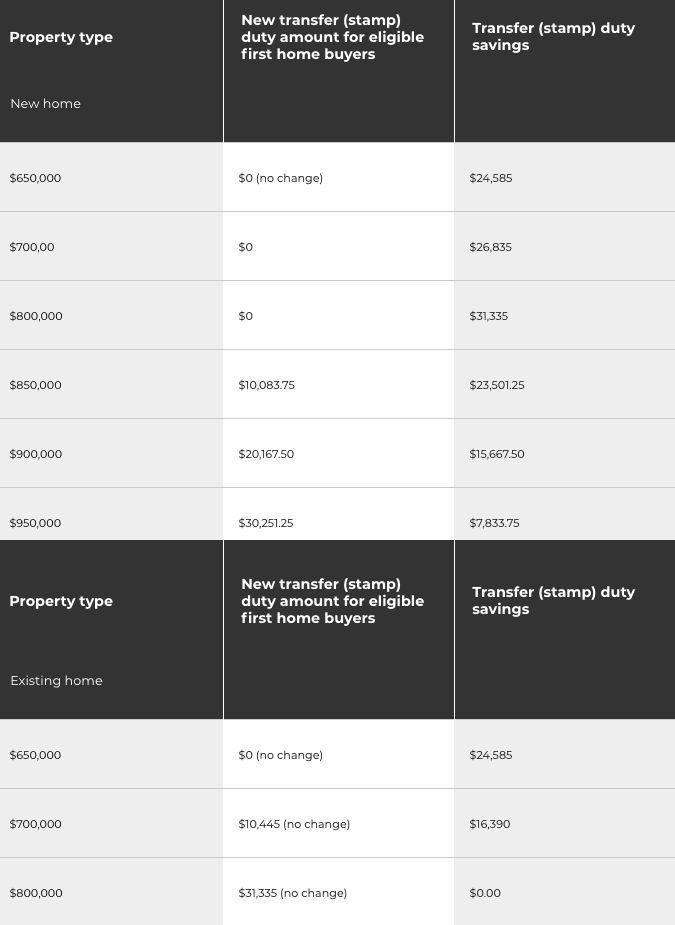

First Home Buyer Assistance Scheme: 1 August 2020 – 31 July 2021

New homes

- Buy a new home valued at less than $800,000, apply for a full exemption, and pay no transfer duty.

- Buy a new home valued between $800,000 and $1 million, and apply for a concessional transfer duty rate. The amount will be based on the value of your home.

Existing homes

- Buy an existing home valued at less than $650,000, apply for a full exemption and pay no transfer duty.

- Buy an existing home valued between $650,000 and $800,000, and apply for a concessional transfer duty rate. The amount will be based on the value of your home.

Vacant land

- You won’t pay transfer duty if your land is valued at less than $400,000.

- For land valued between $400,000 and $500,000, you’ll receive a concessional rate.

See bellow on the table how much savings you can have by choosing the right asset.

As you can see there are many ways of starting in a good way when purchasing your first home.

You do not have to do this alone.

Sometimes having to worry about all these things can be overwhelming and takes from the excitement of the experience. This where my services come in handy. I can assist you in finding you a suitable fit. Let’s Chat!

Australia has one of the hottest property markets in the world, Aussies LOVE property!

Now more than ever with CASH cheap and so many incentives it’s really easy to lose track of what you can possibly be eligible for if you are in the market as First Home Buyer (FHB).

In this first post I’ll focus in NSW.

share to