What I wish I knew before I bought my first property

The first home dream is the most beautiful and exciting thing we could possibly dream of after forming a family.

The idea that our parents passed to us that rent is a bad thing and we need to have our own home it’s usually something most of us have in common.

Now when we bring this idea to Australia, sometimes doesn’t always work out the best way.

The economy, banking, wealth distribution it’s very different from other countries.

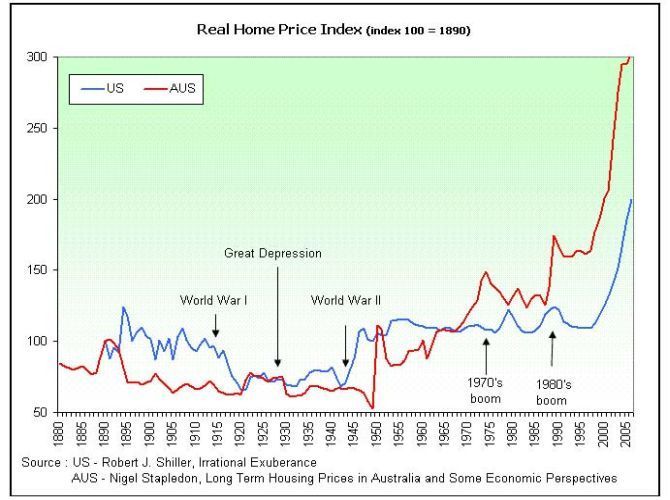

In over 100 years the Australian property market proved to be resilient and with a very focused direction: UP

The idea that you must wait for the right moment in order to buy it is so vague.

Originally, before I even bought my first property I was waiting, waiting, waiting, all the people around me telling me that there was a bubble and prices could not possibly continue to go up.

The way I was feeling on the other side was, every time I thought I had enough money for a deposit the prices would spike up and my dream of owning something going further away.

Then a second concept would kick in, the idea of finding the ideal home, the dream place, in the perfect location with the perfect layout.

Once you add all those components together. Let me tell you, buying something becomes almost impossible.

After 13 years of Australia and property market let me share with you what I wish someone would have told me back then and most important I wish that I would have listened to.

- Your first property will not be your last property;

- Your first property will not be perfect;

- Your first property will be only the first stepping stone into the property market;

- Your first property doesn’t need to be for you to live in;

- Your first property should be bought with the calculator not with your heart;

Those 5 things that seam to be so clear now, were not clear back then.

When doing my property research I would never go and Google and search for the relevant information I should be looking for. All I did was to go on RealEstate.co.au and search for sale properties and base my money on those.

If I could go back in time I’d definitely buy my first property using all the advantages of a FHB, then move out after 6 months, make it into an investment property and go back renting where I really wanted to live in a place I really enjoyed but wouldn’t be able to afford.

But I guess this is how we learn, even though I know people that have been waiting for over 5 years to buy something and it’s never the right time, the right property or the right price.

What I learned is that you must take a leap of faith and get into the game.

Only when you are in the game you can play and possibly have the chance to win!

I make my living today helping people have a clear vision on how to get into the property market, so if you relate to this blog and wish to have a chat with me book a time and let's talk, I'm happy to help!

share to