According to a new report studied by an investment property advisor, climate change poses the greatest threat to coastal property in Australia. That could affect property values and increases the related costs.

Climate change-induced storm surges and coastal erosion threaten to destroy $25 billion worth of coastal residential property in Australia, according to a new whitepaper from CoreLogic.

An overview of the coastal risk score by an investment property advisor

For each property in Australia, CoreLogic's Coastal Risk Score categorises it into one of five distinct risk levels, ranging from no risk to high, medium, or high risk.

'Very High' risk dwellings may be impacted by the coastal retreat in the next 30 years, and may also be at substantial storm surge danger.

With 12,694 residences and 9,441 units in the High or Very High-Risk category, there are more than 900,000 homes that are at risk of being exposed to coastal erosion. These residences are worth $5.3 billion and $19.6 billion, respectively, in terms of residential value.

What are the riskiest areas?

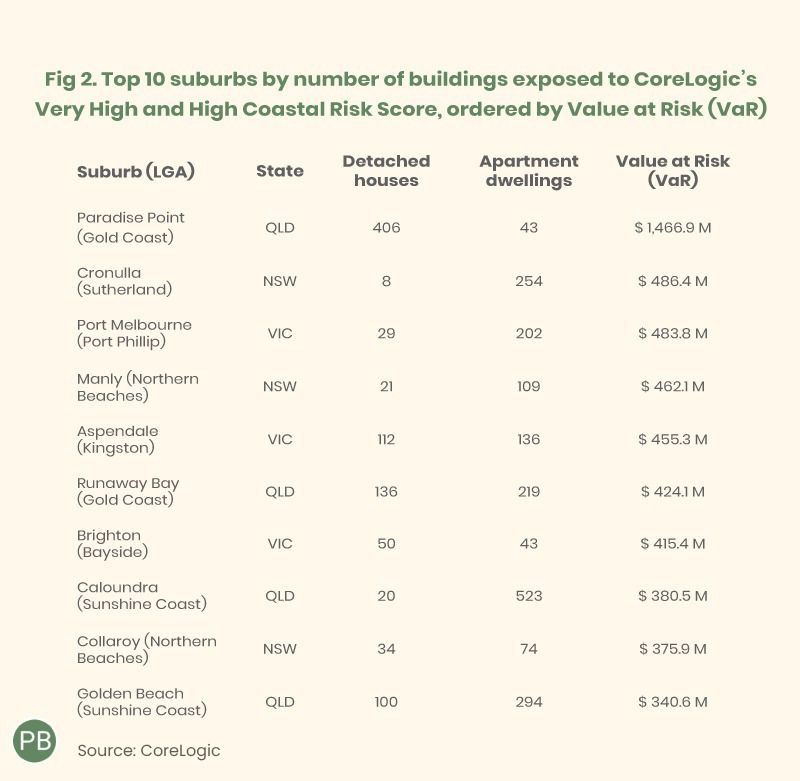

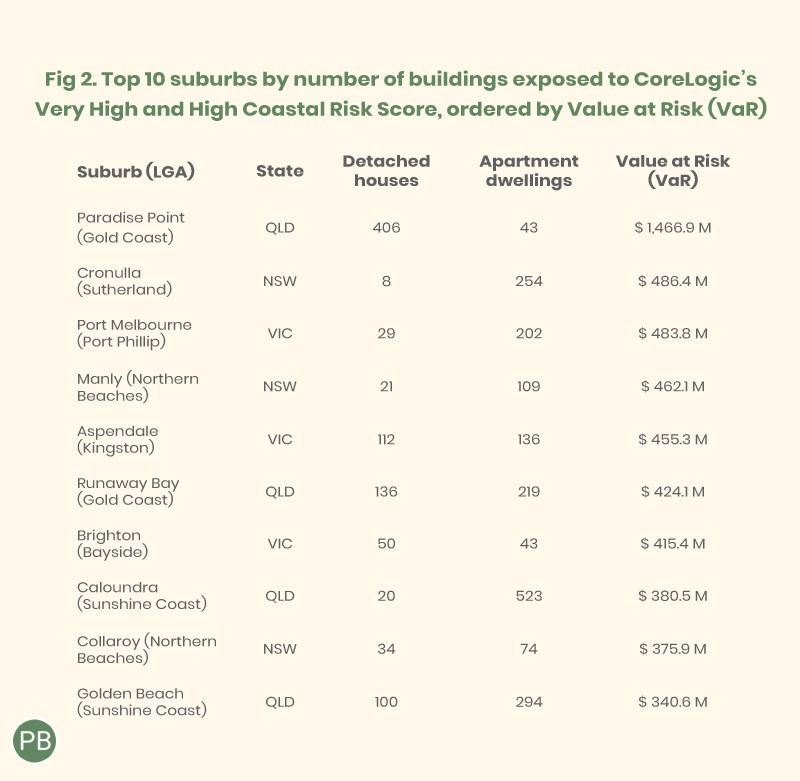

CoreLogic reports that "Very High" risk" suburbs are defined by their proximity to the shore, low elevation, fastest coastal retreat, and high property prices. Many of these at-risk properties in Australia are around the Gold and Sunshine Coast in Queensland, Cronulla and the Northern Beaches in New South Wales, and Port Melbourne in Victoria.

The highest ten suburbs in terms of structures at risk, as measured by the CoreLogic Extreme and High Coastal Risk Score (VaR)

Read on to the property forecast for the Australian property market in 2022 and beyond.

Exactly what does this mean, explained by an investment property advisor?

Coastal risk will crystallise over the next three decades, according to Dr Pierre Wiart, CoreLogic's head of consulting and risk management. Dr Wiart described recent extreme weather occurrences as "concrete repercussions of climate change."

"As a direct result of this, people are suffering both physically and financially. Coastal risk can affect property assessments, home loan viability, and insurance premiums "

More and more people are choosing to work from home and this is resulting in an increase in the value of coastal properties, according to CoreLogic research director Tim Lawless.

According to the investment property advisor, the annual median value of

- Queensland's Gold Coast and Sunshine Coast increased by 34.0%

- 34.4% between January 2022 and February 2019.

This data will enable businesses to adopt a sophisticated approach to measuring the impacts of climate change and improving risk management and making data-driven decisions that benefit their customers, said Dr Wiart.

He concluded, "while this may be surprising or even confronting information for homeowners, this crucial data will assist customers to make the best property decisions and help them plan for long-term wealth preservation."

There are many various elements to consider when investing in real estate; it is not as simple as purchasing houses or renting them out.

In other words, if you're interested in developing an entirely risk-free property portfolio, I'd be pleased to assist you here at PB Property.

An investment property advisor is always a great tool to use while building a risk-free property portfolio.

share to