Despite the hurdles posed by COVID-19 and a series of lockdowns, according to Investment Property Advisor, Australia's real estate market saw a once-in-a-generation rise in property prices in 2021.

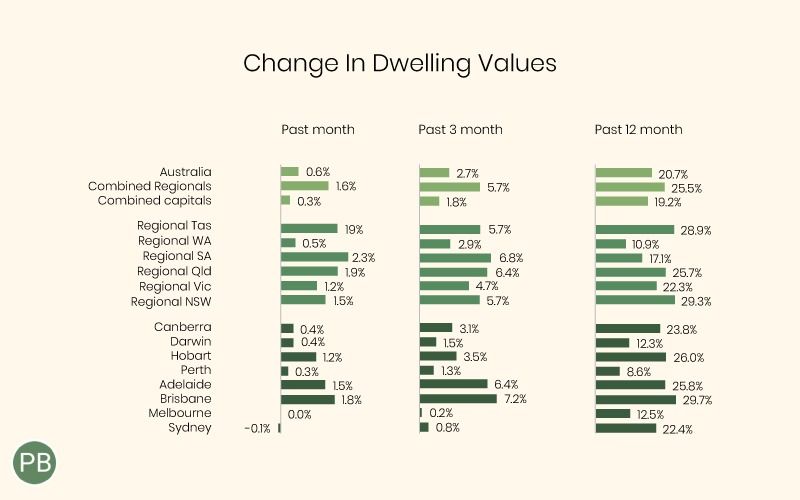

Even while the rate of property price increase is moderating, and our regulator, the Australian Prudential Regulation Authority (APRA), wants to see the housing markets slow down, property prices continue to rise in practically every market throughout the country.

Sydney property prices have increased by almost 25.5% in the last year, Melbourne by 14.9%, and Brisbane by 29.2%.

However, since March of last year, the pace of increase has slowed.

(Source: CoreLogic, March 1st, 2022)

"How long can this last? Is the property market going to crash in 2022?" this is what some potential buyers are wondering now.

They must be listening to the Perma bears those who constantly keep warning anyone who will listen that the property markets are about to fall, but they've been wrong in the past and could be wrong again this time.

RENTS WILL DRASTICALLY INCREASE.

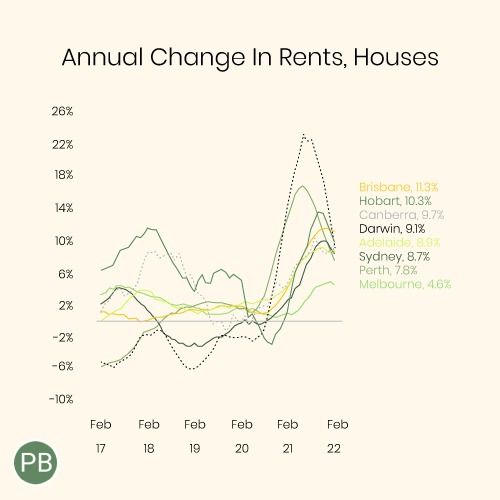

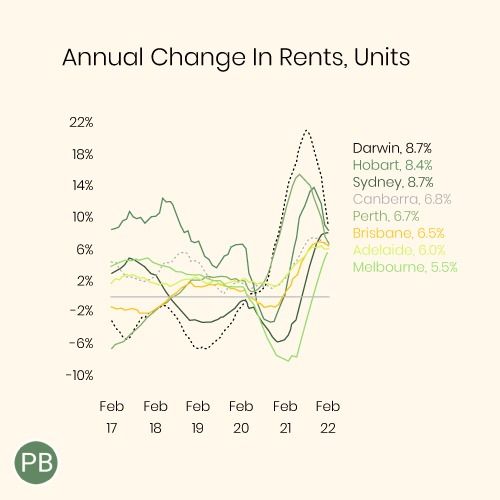

Rental rates will continue to grow throughout 2022 due to increased rental demand at a time when vacancy rates are extremely low.

After the opening of our international borders, demand for rental homes has risen even more.

When individuals first migrate to a nation or region, they almost always rent first.

When international students will return, we will see greater pressure on apartment rents near educational institutions and in our cities' central business districts.

Despite the absence of immigration in recent years, simply look at how rental prices have risen, particularly for houses.

Apartment rentals will also rise in 2022, since rising home rentals will cause affordability concerns for many renters.

Here are the predictions by banks for property prices in 2022

In reaction to the market’s resiliency in the face of extended lockdowns, all four major banks adjusted their property price projections towards the end of last year.

For the years 2022 and 2023, they have the following property price forecasts:

1. Property values are expected to rise 4.9% in 2022 and dip 4% in 2023, according to NAB.

2. ANZ expects a 6% price increase this year, followed by a 4% decrease in 2023.

3. The CBA predicts a 7% increase in housing prices in 2022, followed by a 10% increase the following year.

4. Westpac forecasts an increase of 8% in 2022 and a correction of 5% in 2023.

Economic factors will be different in the next two years than they have been in the previous several.

Slower growth rates in the future may entail a reduction in debt accrual for Australian families, reducing the need for additional APRA action.

What does the future hold for our property markets from the eyes of an Investment Property Advisor?

LET’S TAKE A LOOK AT SIX PROPERTY TRENDS THAT MIGHT HAPPEN IN 2022.

1. Property demand from buyers is expected to remain robust.

Property prices are now increasing across Australia, auction clearance rates remain high, and the media continues to remind us that we are amid a property boom.

As a result, feelings are running high right now, with FOMO (fear of missing out) being a prominent topic in Australia’s property markets.

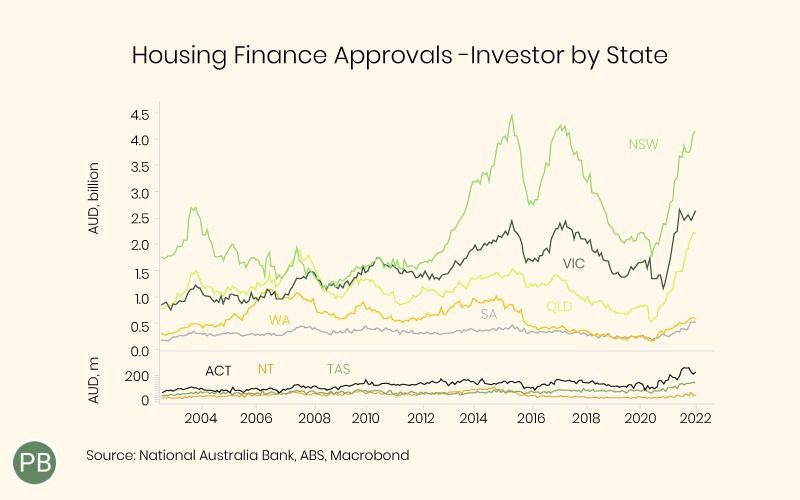

2. First home buyers will be squeezed out by investors.

While many first home buyers (FHBs) were in the market in the first half of 2021, bolstered by a slew of incentives, FHB demand is diminishing as property investors re-enter the market and property values rise.

3. The property price shall continue to grow says the investment property advisor

While many variables influence property prices, consumer confidence, low-interest rates, economic growth, and a favourable supply and demand ratio are the key drivers of the property price increase.

There are numerous real estate markets around Australia, as there have always been, but property values should continue to rise substantially throughout 2022.

This year, real estate in Sydney's bigger regional regions, particularly lifestyle areas such as Byron Bay, the Central Coast, the Hunter Valley, Wollongong, and the New South Wales south coast, should do well, with seaside suburbs expected to outperform the general market.

To learn more, watch, https://www.youtube.com/watch?v=5Xw06fvYdOc

Investment property advisor states that there is a less decent property for sale right now, and many of the good ones are off-market.

share to