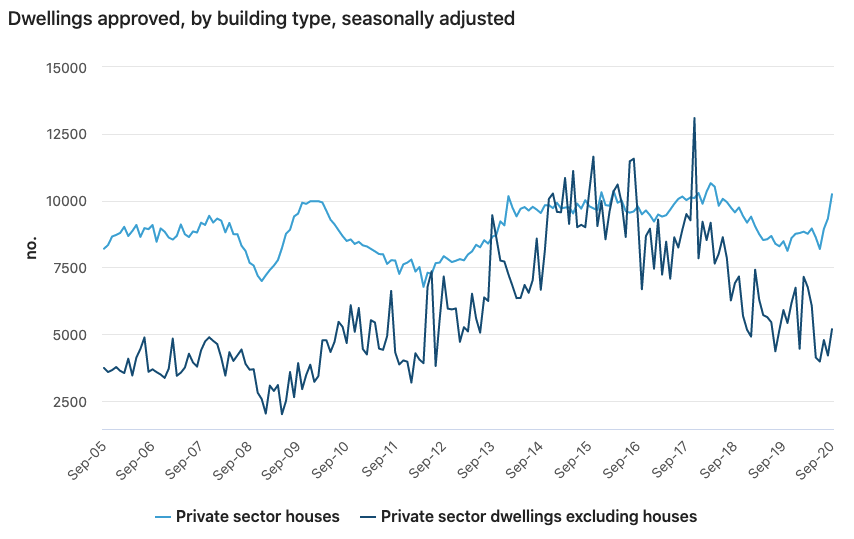

Building Approvals

To continue the Property Story the latest data released by the ABS shows that Building Approvals have increased to 15.4% last month and year to date 8.8% the private house sector is booming as well with an increase of 20.7% year to date while the Unit market still in decline with -12.1% year to date.

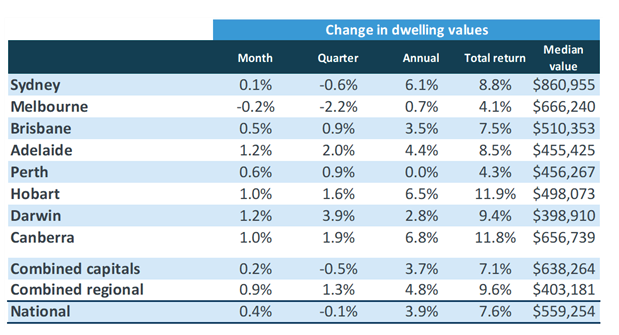

CoreLogic finally some good news

CoreLogic October home value indices Australian housing values move into recovery mode. Following five months of consistent declines in residential property values, CoreLogic’s national home value index moved back into positive month-on-month growth through October, posting a 0.4% rise. The lift in home values was broad based, with every capital city apart from Melbourne posting a rise in values over the month.

According to CoreLogic’s Head of Research, Tim Lawless, the October results show early evidence of a divergence between house and unit market performance. “The rise in capital city housing values over the month was entirely attributable to a 0.4% lift in house values which offset the 0.2% fall in unit values. Through the COVID period so far, unit values have actually shown a smaller decline in values than houses”… read more here

Unit prices have not seen big shift in price as most of them are rentals, however there has been a strong demand in the market of dwelling on the lower price and cheaper suburbs especially with the low interest rates making buying a brand new home much more appealing than renting close to the CBD.

Property is still strong and even though we have that panic mode in the early months of the Pandemic, comes to show that the demand is strong, the fundamentals are strong and property is still a very important part of the Australian economy.

2021 is looking very favourable for the property market and prices will continue to raise.

Are you in the market? Need some guidance?

Let's chat!

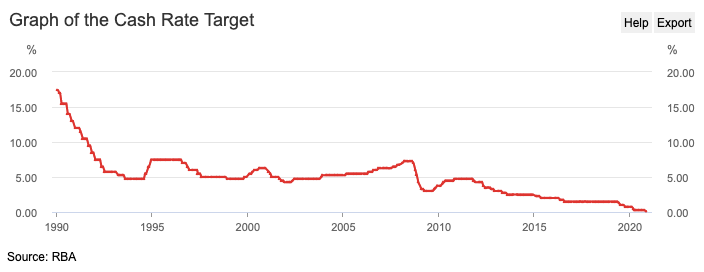

RBA Cash Rate November 2020

For the 11th time since 1990 the RBA made an official cash rate movement in order to put more monetary stimulus into the market, moving the cash rate from 0.25% to 0.1%, this is 15 basis points down an Australian Record low. The question is will the Banks pass this to the consumer or not? See the full trend here.

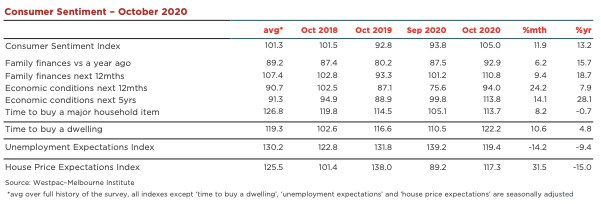

Time to Buy a House Index by Westpac

Confidence in the housing market has boomed. The ‘time to buy a dwelling’ index increased 10.6% to its highest level since September 2019. As with the overall Index the result for NSW (now 120.4) was outstanding with an 11.3% rise compared to 7.0% in Victoria (now 118.0) and 4.4% in Queensland (now 118.6). Read the full Westpac report here.

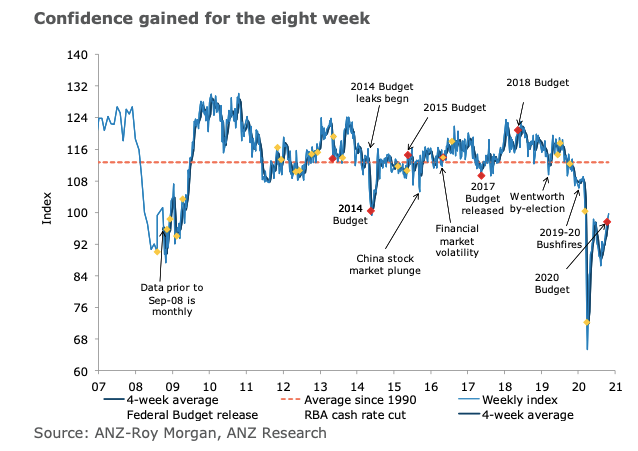

ANZ-Roy Morgan Consumer Confidence increases for eighth straight week

ANZ-Roy Morgan Consumer Confidence increased 1.6pts to 99.7 on October 24/25, 2020 and is now 10.7pts lower than a year ago on the comparable weekend of October 26/27, 2019 (110.4) and is now 5.6pts above the 2020 weekly average of 94.1. Consumer Confidence is now at its highest for over six months since March 14/15, 2020 (110.4). Download full report here.

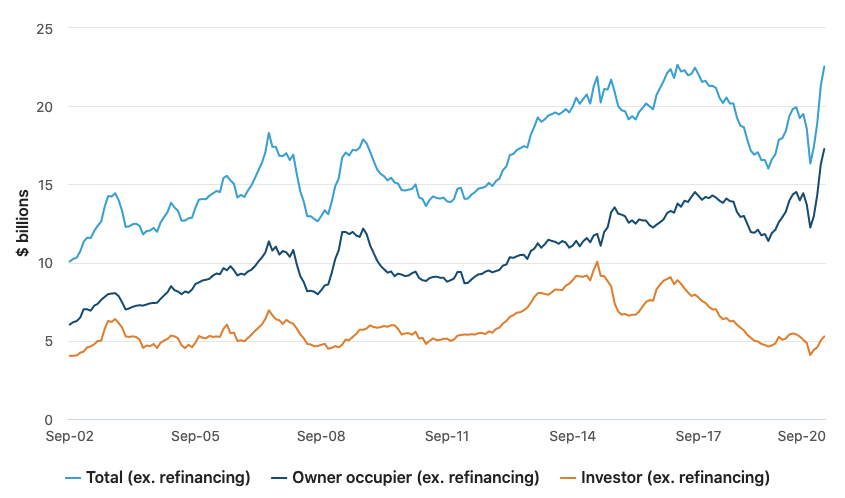

Housing Finance

Housing Loan Commitments data released by the ABS show an increase of 5.9% last month and year on year and increase by 25.5%.

First home buyers leading the way with a 6% last month and year on year an increase of 33.8% showing is definitely a first home buyers market and they are playing a big role taking advantage of all the new government incentives.

Investor landing on the other hand was up 5.2% last month and year on year is up by 4.2%.

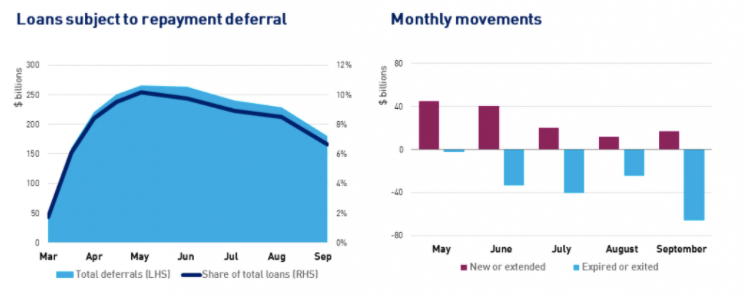

Loan Deferrals Stats

APRA released their latest numbers and shows that at the end of September only 7.4% of the $1.8 trillion housing finance were deferred roughly meaning that only less than 1 out of 10 people are in trouble to repay their loans.

“Exits from deferral continued to outweigh new entries for the third straight month in September, with $66 billion loans expiring or exiting deferral and $17 billion of entries approved or extended. Pace of exits increased significantly over the month, with total exits increasing 169 per cent from $24 billion in August. The majority of these loans have returned to a performing status.”

share to