What is it and why is it happening? Don't be sad

As apartment living becomes increasingly popular in our nation’s capitals, the build-to-rent model of construction is emerging as a new player in residential real estate.

Build-to-rent is a long-established phenomenon in Europe, where it made up nearly a fifth of the entire commercial market as of early 2020.

Build-to-rent apartment complexes are designed and constructed by a developer who retains ownership of the building when it’s complete. The apartments are then rented out to tenants by the developer, which also manages and maintains the complex.

These developments sometimes have the backing of an institutional investor like a superannuation fund.

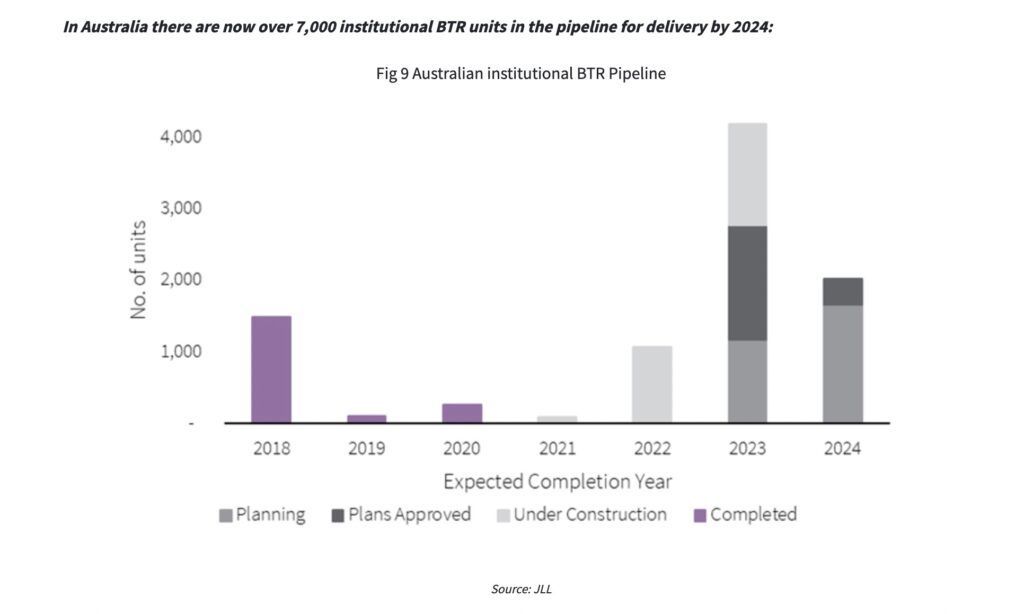

The giant Mirvac are about 10,000 build-to-rent apartments currently in the pipeline to be completed in Australia, from various developers.

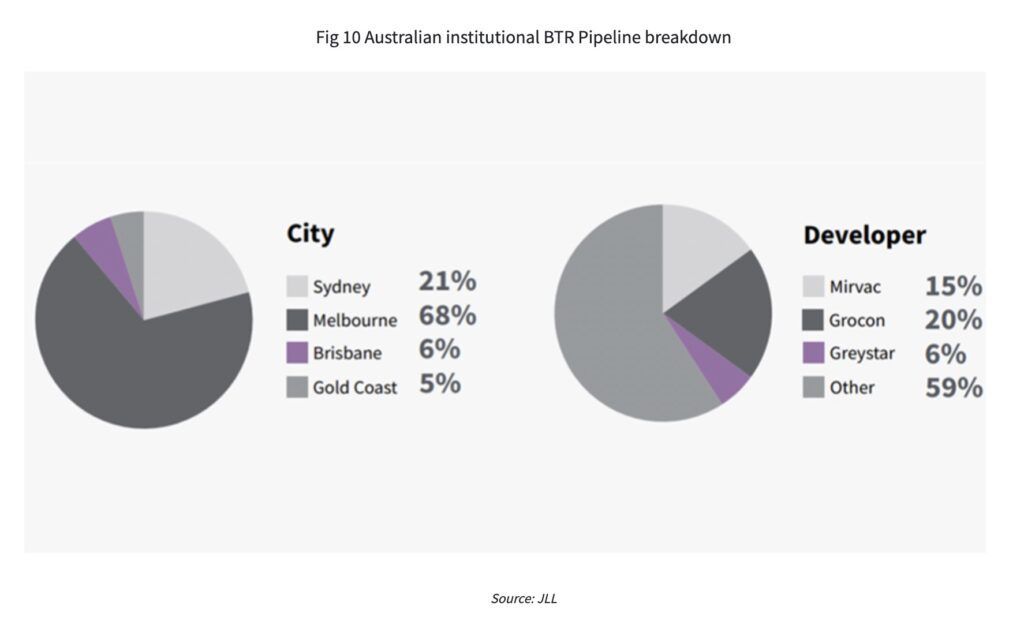

Mirvac opened its first major build-to-rent development, LIV Indigo, in Sydney’s Olympic Park last year. This development has 315 apartments, ranging from one to three bedrooms. The company plans to build 2,200 similar developments across Sydney, Melbourne and Brisbane within the next four years.

Build-to-rent developments offer a number of potential benefits to tenants, things link longer terms with different renewal conditions, low or no rental bonds, and the ability to decorate an apartment (painting the walls, for example) and have pets without pre-approval.

Swapping units in the same complex like upsizing to bigger apartments when starting families, while some have downsized to one-bedroom apartments, choosing to access co-working spaces in the building instead of using their second bedroom as a home office.

Build-to-rent properties are designed to attract and keep tenants, as opposed to attracting a landlord who may never live there or an owner occupier who may not want to pay high body corporate fees.

These can range from such things as pools and shared outdoor spaces and BBQ areas through to gyms, yoga studios, communal working spaces, community gardens and even cinemas. Cleaning and maintenance services can also be included.

Some build-to-rent projects have requirements to include lower-cost housing to those people who might not otherwise afford it.

State governments around Australia have begun to recognise build-to-rent developments as a potential means of providing affordable housing. In May of 2021, the Queensland State Government announced a partnership with the construction industry to deliver two new apartment developments in the Brisbane suburbs.

Could this be the solution for affordable housing? But what happens when your pension can’t pay for the rent anymore?

Interested? Let’s chat!

share to