Despite the current challenges facing Melbourne's property market, including recent land tax changes and the ongoing recovery from COVID-19, many savvy investors see a golden opportunity. Legendary investor Warren Buffett famously advised, "Be fearful when others are greedy, and greedy when others are fearful." This principle rings true today, as the negative press and daunting numbers may be obscuring the true potential of the Melbourne market.

The Impact of Recent Land Tax Changes

Victoria's recent land tax reforms, part of the COVID Debt Repayment Plan, have significantly impacted property investors. The changes aim to increase government revenue to repay the state's pandemic-related debt. Key aspects include higher tax rates for high-value properties and a reduction in the tax-free threshold . This shift has made some investors wary, as even apartments, which traditionally avoided land tax, are now subject to these new rules if they surpass the lower threshold .

However, savvy investors understand that such challenges can lead to opportunities. With some property owners potentially looking to offload assets to avoid higher taxes, buyers may find attractive deals on the market. The full details of these tax changes can be found on the State Revenue Office of Victoria's website.

Melbourne's Market Recovery Post-COVID

The pandemic had a significant impact on Melbourne's property market, with extended lockdowns leading to decreased buyer activity and fluctuating prices. However, the market is showing signs of a rebound as life gradually returns to normal. Recent reports indicate that while some areas are still struggling, others are experiencing renewed interest and price growth .

Melbourne remains one of the most liveable cities in the world, thanks to its vibrant culture, strong infrastructure, and diverse economy. These factors continue to attract both local and international buyers. As more people recognise the city's potential for long-term growth, demand is expected to increase, further stabilising the market .

Units vs. Houses: The Value Gap

Another strategic consideration for investors is the price disparity between units and houses in certain suburbs. In many Melbourne suburbs, house prices have surged to more than double the value of units . This gap presents an opportunity for buyers to invest in units, which offer more affordable entry points and potential for appreciation as demand for more budget-friendly housing increases.

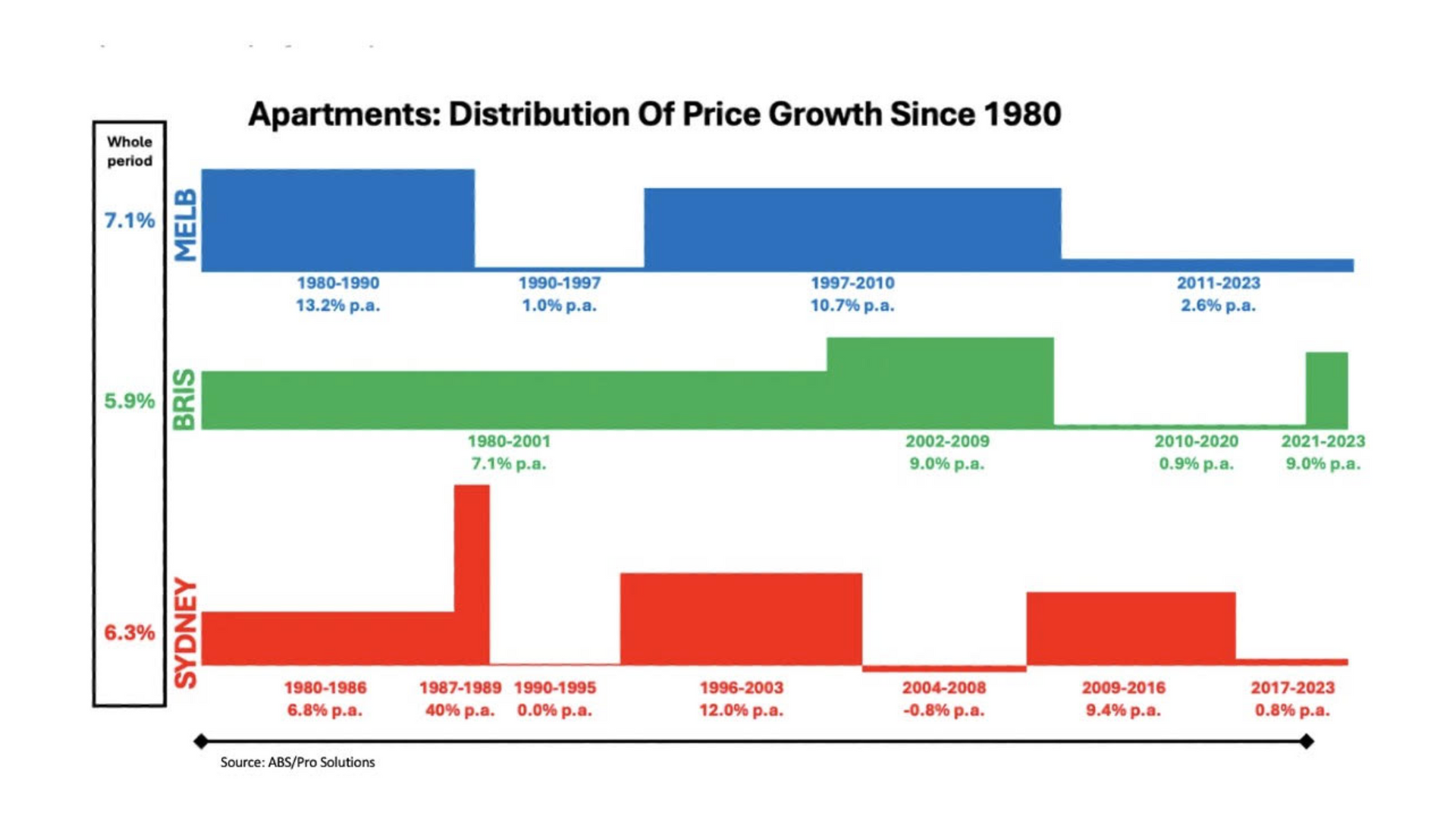

If you look at the Graph below:

What we also like to look at is the low market growth within the Melbourne apartment cycle. The market has now stretched to 13 years with low growth rates.

However then you have to consider the longer it stretches the closer you are to the growth point & higher levels of growth.

We had a similar situation in Brisbane where growth rates were compressed and then a spike followed. Which you can see in the Brisbane's cycle below.

So looking below, we are primed for some good things in the Melbourne apartment market, but as always we can't predict the exact time...this year, next, year after, but the longer it takes the more the build up & potential for bigger growth numbers.

It's nearly always a good strategy to look for value and growth trends.

Signs of a Rebound

Some media outlets are beginning to report on Melbourne's property market rebound. As the city adapts to new norms and recovers from the pandemic's economic impacts, there's increasing optimism about its property sector's future . With infrastructure projects underway and a steady influx of new residents, Melbourne's long-term prospects remain bright.

Seizing the Opportunity

For investors considering the Melbourne market, now is the time to act. The combination of market uncertainty, tax changes, and the COVID-19 recovery presents unique opportunities for those willing to take a calculated risk. By focusing on undervalued segments like units and leveraging the current buyer's market conditions, investors can position themselves for substantial returns.

Read Full Articles: FR and SMH

In conclusion, while Melbourne's property market faces challenges, the fundamentals that make the city attractive remain unchanged. By following Warren Buffett's advice and being "greedy" when others are "fearful," investors can make strategic decisions that will pay off in the long run. Melbourne's potential for growth and its enduring appeal as a liveable city make it a market worth considering for both new and seasoned investors.

"If You are a Melbourne Investor just like me HOLD IN THERE!!" - Pina Brandi

share to