Again?

If this title sounds familiar to you is because I stole it from the SMH from March 25, 2010.

These types of news only stop the first time investors or people that have never made a move and now they use it as excuse to see what’s going to happen.

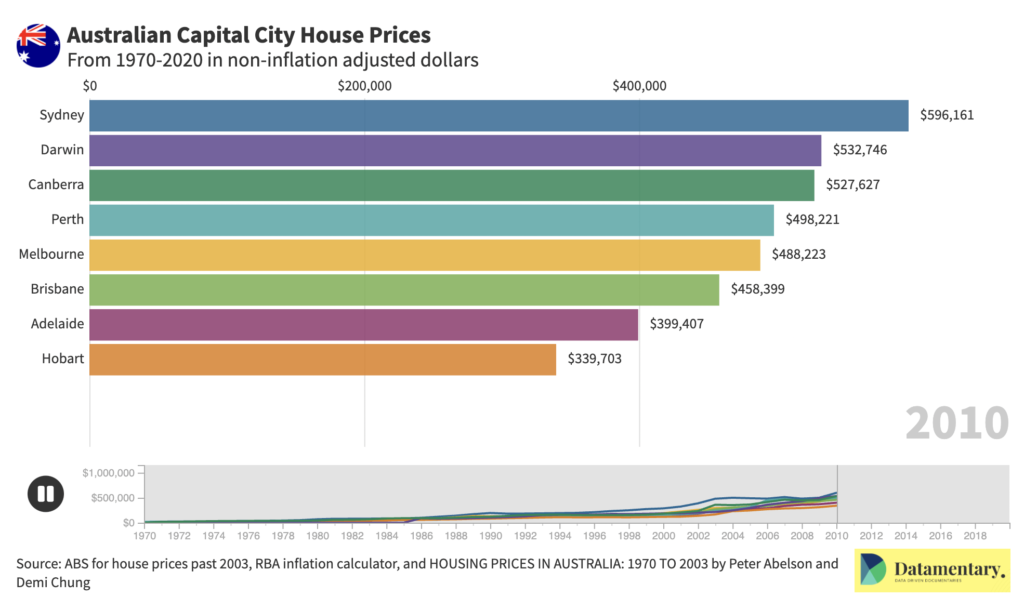

Well, what did actually happen?

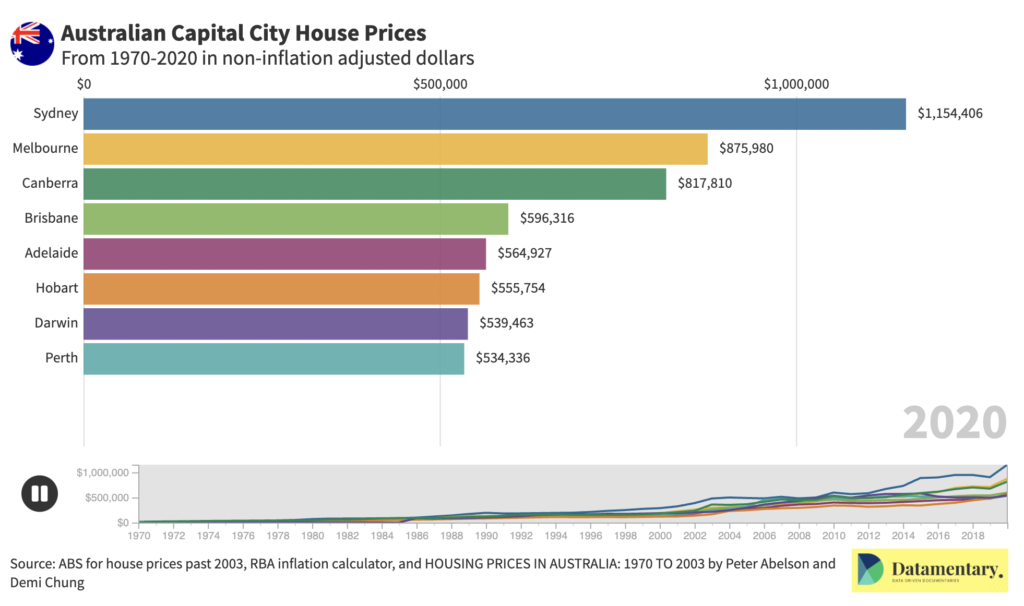

As you can see no crash has happened and these numbers stop at 2020 as 2021 is not over yet.

Having said that we had one of the strongest property seasons ever seen and prices instead of dropping by 20% as predicted last year by so many called Economist.

The sad part about all this is that people listen to the wrong advice when comes to invetsment.

They go to the media or they go ask their friend that has never bought an asset in their lives but is an expert in waiting for the "right time to buy".

A lot of people that could have bought earlier than they did were stopped by news written by people that all they want is sell doom and gloom.

How many times do you see a reporter spend time writing a story about ordinary successful people that simply bought when the time was write for them?

In the property market the only people that lose are the ones that are after the quick buck, the ones that sell their property as soon the property appreciates in value.

They forget about Agent fees, Stamp duty, LMI, Removalist, opportunity cost...

Property is an asset that you buy for the long term. It's an asset that has much higher chances of appreciating than the money you park at the bank doing nothing for you.

People forget that while their money at the Bank is returning them a safe 1% per annum it gets completely offset by 3% per annum inflation rate.

Our money in form of cash is worth less and less, so honestly what do you have to lose more?

Get in touch and let's have a talk to see how can I help.

share to