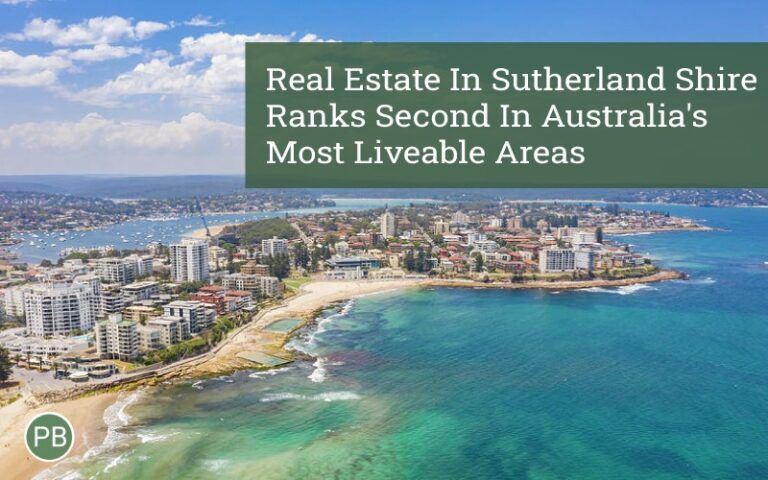

Residents of the Sutherland Shire have long known this, but now it is official. Those who choose to settle in the shire can count themselves among Australia’s most fortunate citizens. This is because the shire has been ranked second in a report listing the most livable metropolitan areas in Australia. Sutherland Shire real estate is booming & you shouldn’t miss the chance to invest in this thriving property market!

Ipsos Report: Sutherland Shire makes a Mark!

International market research firm Ipsos, has revealed this in a new report titled “Life in Australia 2020: Understanding livability across metropolitan Australia.”

Ipsos surveyed 14,010 Australians and asked them to select the top five characteristics that make a place desirable to live in. On a 0 to 10 scale, we asked to rate the livability of their neighbourhood based on 16 unique attributes.

The shire rated above average all but four of the 16 ‘livability attributes’.

A livability index of 0 to 100 was used to select the most and least livable areas. To create the index, they multiplied each attribute’s importance by how well Australians rate its local performance.

Feeling safe, affordable & decent housing, high-quality health care, reliable & efficient public transportation and access to the natural environment. These are the five factors that make a place desirable to live in as per the report.

It took the researchers 42 metro areas to determine that Sutherland Shire had the second-highest livability index in Australia. Do checkout our podcast to know why Sutherland Shire real estate is an ideal investment destination!

Adelaide central and Hills, which had an index of 71.5, narrowly beat the Shire. But Perth, Brisbane, and Melbourne were all ranked lower.

Some areas, like Sydney’s south-west, Queensland’s Blacktown, Logan, and Ipswich, and Melbourne’s north-west, underperformed comparatively.

Future Plans for this Awesome Area

The report came as “no surprise” to Sutherland Shire Mayor Steve Simpson or any of the region’s over 230,000 residents, he said.

As councillor Simpson put it, “you can’t duplicate our quality of life, our stunning natural surrounds, our thriving local business community, and our warm and welcoming community spirit.”

Adelaide scored higher in cultural offerings like museums, galleries, and festivals in comparison to the shire. We planned major renovations for two of the most cherished venues in town. As Mr. Simpson says, we commit to supporting the growth of the community’s performing arts venues.

Sutherland Memorial School of the Arts and the Sutherland Entertainment Centre will soon be able to host an even greater variety of high-quality theatre and entertainment offerings for residents and visitors to the region.

However, we are still making significant investments in the future of our local arts sector despite a slight lead in cultural offerings, such as museums, galleries, and festivals, in Adelaide.

Residents and visitors alike will soon be able to enjoy a wider range of high-quality theatre and entertainment options in Sutherland Shire. This will be possible owing to the renovation and significant upgrade of the Sutherland Entertainment Centre and Sutherland Memorial School of Arts.

He also cautioned Adelaide to be on the lookout for trouble the following year.

He said, “We’re aiming for the top spot next time.”

PB property is currently selling off-the-plan apartments in The Shire. For more information on this project, call 0425 395 795 or book a free appointment!

share to