In the great Australian dream, owning your own home has long been the end goal. But with rising property prices, fluctuating interest rates, and evolving lifestyle preferences, more Australians are questioning: is buying really better than renting? And what are the true costs involved in ownership beyond just the mortgage?

This blog post unpacks the real difference between renting and buying property in Australia, highlighting often-overlooked holding costs, lifestyle considerations, and financial trade-offs — especially for buyers at the lower end of the market. We’ll also provide a cost comparison table between owning and renting a house or apartment.

1. The Emotional Appeal vs Financial Reality

Home ownership is often seen as a rite of passage in Australia. It provides stability, a sense of pride, and the freedom to make a home your own. However, these emotional benefits come with financial obligations that go far beyond the monthly loan repayment.

Renting, on the other hand, offers flexibility and lower upfront costs. But many renters feel like they’re "throwing money away" without building equity. Let's break down the details.

2. Upfront Costs: Buying vs Renting

Buying a Home:

- Deposit: Usually 10-20% of the property price.

- Stamp Duty: A significant state tax (can range from $10,000 - $50,000+ depending on the property and location).

- Legal & Conveyancing Fees: $1,500 - $3,000.

- Lenders Mortgage Insurance (LMI): If you borrow more than 80%, this can cost thousands.

- Building & Pest Inspections: $500 - $800.

- Strata Report: $250 - $350

Renting a Home:

- Bond: Usually four weeks' rent.

- First Month’s Rent in Advance: Required upon signing lease.

- Application/Agent Fees: Usually minimal.

3. Ongoing Holding Costs of Owning

When you're a homeowner, your costs extend well beyond the mortgage:

- Council Rates: Typically $1,000 - $3,000/year.

- Water Rates: $600 - $1,000/year.

- Home & Contents Insurance: $1,000 - $2,500/year (higher for houses and areas prone to natural disasters).

- Repairs & Maintenance: Average 2% of property value annually (i.e., $16,000 on a $800k home).

- Body Corporate/Strata Fees: Common for apartments/townhouses; ranges from $1,000 to $10,000+/year.

- Loan Interest: Varies depending on rate and loan amount. At 6% on a $600k loan, you could pay $36,000/year.

These are often invisible to renters who only see the cost of rent.

4. Lifestyle Impacts & Location Trade-Offs

For those at the lower end of the purchasing power spectrum, owning property often means compromising on location and lifestyle.

- Commute: More affordable homes may be located far from city centres, increasing commute time and transport costs.

- Access to Amenities: Rental properties in inner suburbs may offer better access to public transport, schools, cafes, and jobs.

- Home Quality: First-time buyers may need to purchase older homes needing renovation, while renters may access more modern or well-maintained homes.

Renters, especially younger professionals, may prioritise lifestyle, mobility, and work proximity over long-term equity building. But this trade-off has financial implications over time.

5. Opportunity Cost of Buying

When you buy, you're tying up a large amount of capital in your home. This limits your flexibility to invest elsewhere.

For example:

- Rentvesting (renting where you want to live and investing in a more affordable area) is growing in popularity for this reason.

- Check out this Video where we show one of our success stories in this subject.

6. Long-Term Wealth Building: Ownership vs Renting

Despite the higher upfront and ongoing costs, home ownership remains one of the most effective long-term wealth-building tools for Australians. Property values have historically grown at around 6-8% annually in major cities.

Renters miss out on capital growth and face rent increases over time, while owners can lock in repayments (on fixed loans) and build equity.

7. The Risks of Ownership

Homeowners bear more financial risk:

- Interest rate hikes can increase repayments significantly.

- Unexpected repairs (storm damage, plumbing issues) can cost thousands.

- If you need to sell in a downturn, you may sell at a loss.

8. Renting: Flexibility & Affordability

Renting offers:

- Easier relocation for work or lifestyle changes.

- No responsibility for repairs or maintenance.

- Lower entry costs.

But:

- You don’t build equity.

- You may have to move frequently.

- You’re subject to rent increases.

9. When Renting May Be Better

Renting may make more sense if:

- You're planning to move within 3-5 years.

- You want to live in a high-priced suburb you can't afford to buy in.

- You prioritise travel, lifestyle, or career flexibility.

- You're not financially ready for the hidden costs of ownership.

10. When Buying May Be Better

Buying may be smarter if:

- You plan to stay in one place for at least 5-7 years.

- You want long-term financial security.

- You have stable income and can manage loan obligations.

- You're ready to take advantage of government grants and incentives.

The Future of Renting & Buying in Australia

With housing shortages, high migration, and supply constraints, the property market is likely to remain competitive.

Governments are increasing support for first-home buyers through schemes like the First Home Guarantee and Shared Equity programs.

At the same time, rising interest rates and inflation make it more expensive to own.

Final Thoughts

There is no one-size-fits-all answer to renting vs buying. It comes down to your financial position, lifestyle goals, and future plans.

But if you're considering buying, it’s essential to factor in the true costs of ownership — many of which aren’t visible at first glance. And if you're renting, know that you may be trading flexibility now for delayed equity growth later.

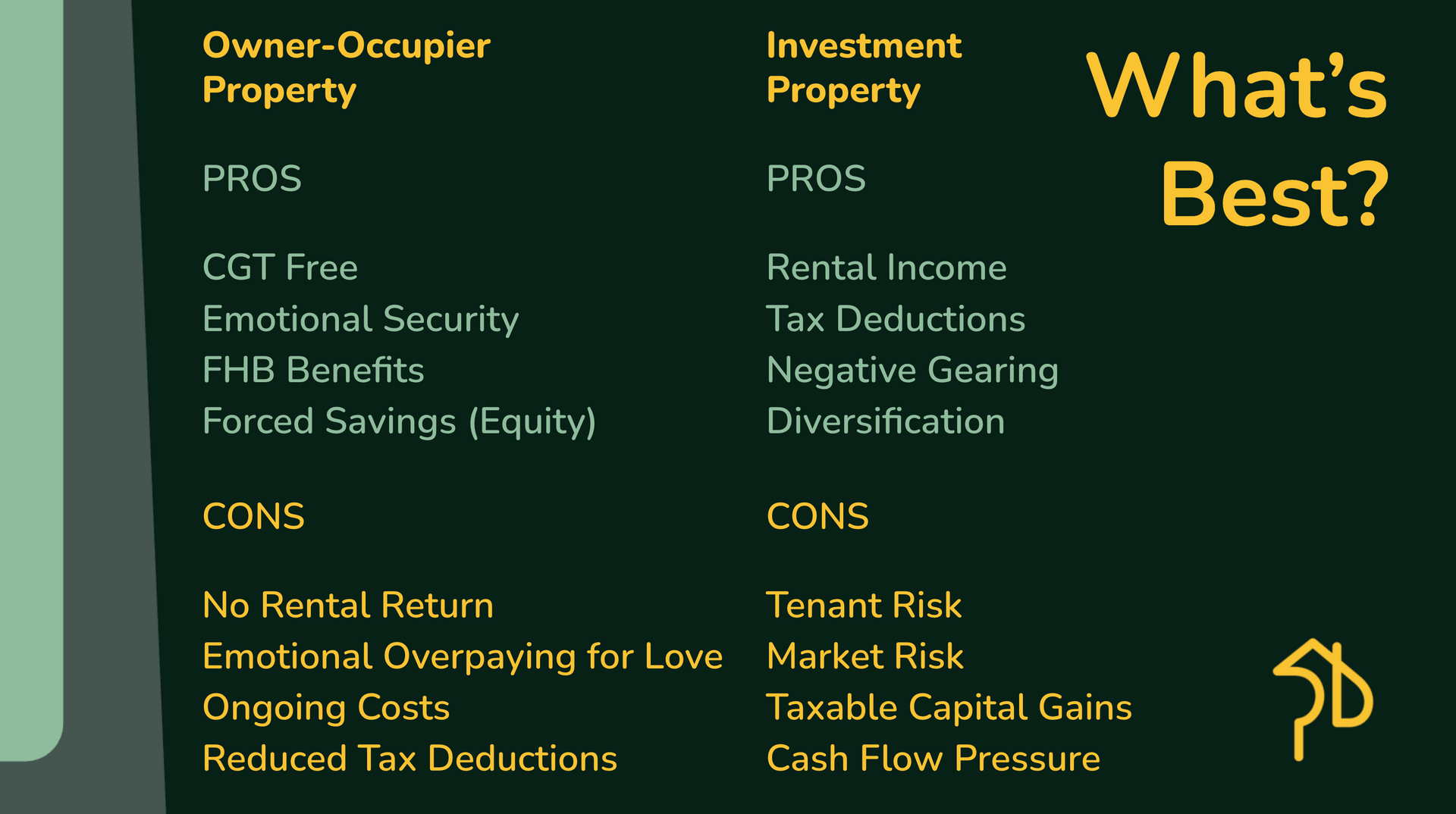

If you choose to rent, it's worth considering buying an investment property instead. This allows you to start building equity and leverage capital growth, even if you're not ready to buy your dream home. In the future, the equity built from that investment can help you upgrade or finally purchase the home you truly want.

By understanding the full picture, you can make the best decision for your future.

If you are in a position where you don’t know what’s best for you from a financial perspective, book a call with us and we can help you see the numbers better so you can make an informed decision. Check out this Video where we show one of our success stories in this subject.

share to