Australia’s population is projected to be 4 per cent smaller by 2030–31

Before the global pandemic hit the world Australia’s population was having a great run and growing at speeds that were never experienced before.

This growth made the government take measures like Infrastructure spending and different types of city planning in order to accommodate all the people that were either to come or to be born.

The Australian government centre for population decided to do a study and release their very first population statement.

In this document you will find everything about how and where the population will grow.

Some of the most interesting data and figures are around the time frame showing that Australia is now 3 years behind the original numbers.

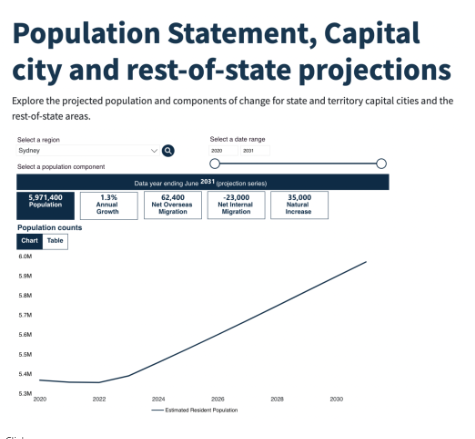

Before the pandemic Melbourne was supposed to take over Sydney population by 2026 when now the expectation is to reach by 2030–31 with a population of 6.2 million, compared to 6.0 million in Sydney.

Capital cities are projected to bear the heaviest impacts, with total population across capital cities estimated to be around 5 per cent lower by 30 June 2031 than in the absence of COVID-19.

By contrast, population outside the capital cities is estimated to be around 2 per cent smaller than it would otherwise have been.

Australia’s population is estimated to be around 4 per cent smaller (1.1 million fewer people) by 30 June 2031 than it would have been in the absence of COVID-19.

The population will also be older as a result of reduced net overseas migration and fewer births. Despite COVID-19, Australia’s population is still growing and is expected to reach 28 million during 2028–29, three years later than estimated in the absence of COVID-19.

Why is population observation so important when you talk about Property Investing?

Simple answer is you need people to live or buy the property from you in the future.

Complex answer is to try to be ahead of what will happen. If you are able to understand what could happen in the future before it happens than you don’t need to fight with others when everyone else is trying to buy.

Once the borders re-open and migration picks up again combined with an undersupply of new stock caused by COVID, that’s where the opportunity will arise!

Are you in the market and need help find your perfect property? Book a Free Chat.

share to