Off-the-plan apartments and townhouses up to $500,000 will not pay stamp duty

Stamp duty will be permanently abolished for all new dwellings bought off the plan in the ACT valued up to $500,000, for owner-occupiers, in a move the ACT government says will increase the supply of affordable housing.

Buyers will save $10,360 in stamp duty on the purchase of an apartment or townhouse worth $500,000 under the change, which will come into effect on Thursday.

The shift will extend part of a stamp duty reduction program that was introduced as a temporary stimulus measure in response to the early economic impact of the COVID-19 pandemic.

Canberrans have not paid stamp duty on off-the-plan apartments and townhouses up to $500,000 since June 4 last year.

The ACT government is making good on its promise of phasing out stamp duty, announcing it will abolish the property tax for off-the-plan apartment and townhouse purchases up to $500,000 from July 1.

The stamp duty abolition will apply to any buyer – first-home buyers, upgraders, downsizers and everyone else in between – who purchase off-the-plan, the territory government said.

Mr Barr said the ACT government was focused on housing affordability in its next phase of stamp duty cuts.

"Whether you're looking to purchase your first home, downsize or upsize, the reduction of stamp duty rates will make it easier to purchase and ensure all Canberrans will benefit from fairer, simpler and more efficient taxes and duties," Mr Barr said.

The ACT budget recorded a $41 million boost driven by a booming Canberra housing market, as stamp duty revenue surpassed Treasury expectations.

Revenue from residential stamp duty made up a huge portion of the increase, the government's quarterly financial report showed.

Stamp duty brought in $157 million in the nine months to March 31, far exceeding the government's expected revenue of $120 million.

“Our priority through the next phase of stamp duty reductions is to focus on the most affordable end of the housing market.

“This is a further step in our tax reform program and one that encourages an increased supply of housing below the $500,000 threshold.”

The announcement forms part of the territory’s 20-year plan to phase out the property tax, which has been underway since 2012.

“If the government hadn’t started this reform back in 2012 … [and it] continued to raise revenue in the same inefficient way, buyers would be paying $20,500 in stamp duty for the same property that will, from tomorrow, permanently have zero stamp duty in the ACT,” Mr Barr said.

“By abolishing inefficient taxes such as stamp duty and replacing this revenue with our fairest and most efficient tax base, we are increasing economic activity in the ACT and supporting housing affordability,” Mr Barr added.

However, according to Allhomes listings, there are only two developments on the market that offer off-the-plan townhouses in Taylor for less than $500,000.

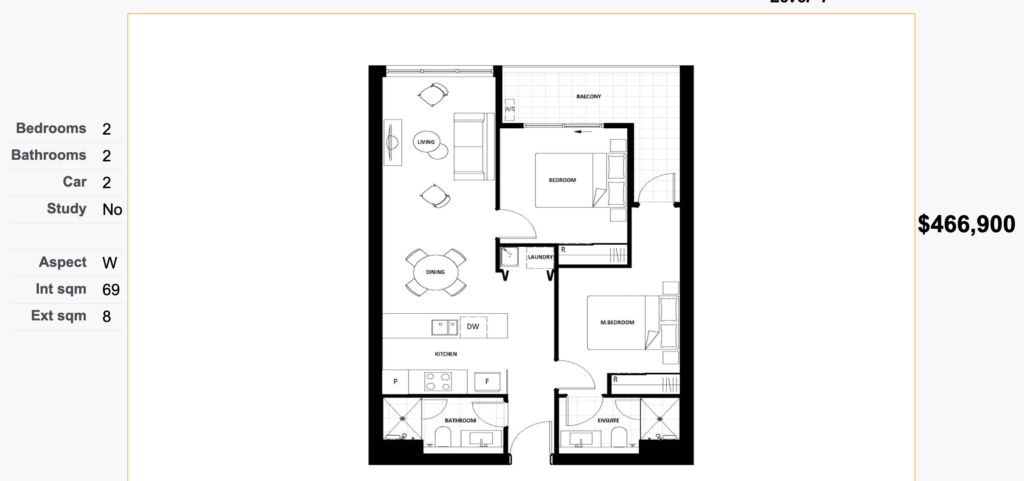

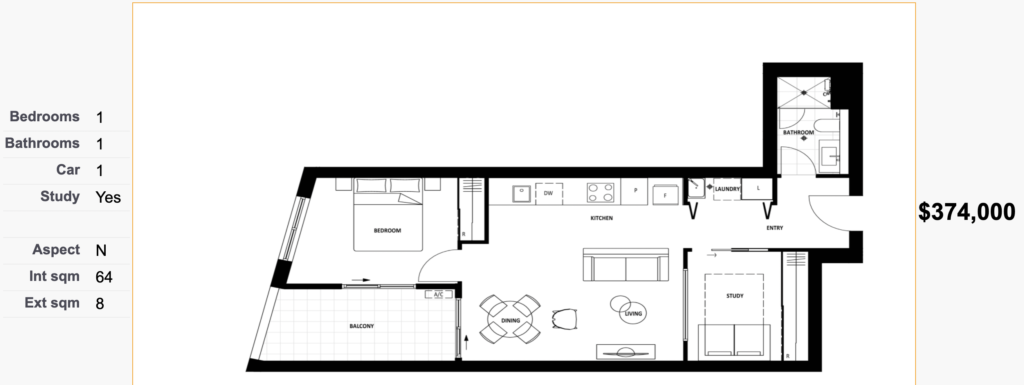

As for off-the-plan apartments, there are more options in new developments that offer one to two-bedroom apartments under that threshold.

Want to take advantage of this opportunity? Contact me.

share to