Was COVID-19 Responsible for property prices to spike?

The study KPMG has sought to understand whether the COVID-19 pandemic has resulted in property prices being on a higher trajectory

When COVID hit they decided to do a study on what impact COVID would have in the Australian Property Market, the full report is detailed, below are some main points.

Key findings

• House prices in most capitals were expected to enter a cyclical upswing at the start of 2020.

• The onset of the COVID-19 pandemic disrupted this cyclical upswing with house prices contracting in all capital cities except Canberra during the June quarter 2020.

• Government policy responses alleviated uncertainty regarding the direct and indirect impacts of COVID-19 on the property market. This, combined with the material decline in mortgage interest rates, has seen property prices rise dramatically in the past 6 to 9 months.

• The rises in residential property prices have been greater than we estimate would have occurred in the counterfactual no- COVID-19 scenario.

• It appears the short-term positive of lower mortgage interest rates has swamped the longer-term negative factors of lower population and price disequilibrium during this recent price spike.

• However, residential property price growth is expected to temper over the next 2 to 3 years as lower population growth, reversion back to equilibrium and higher mortgage lending rates weigh on property prices.

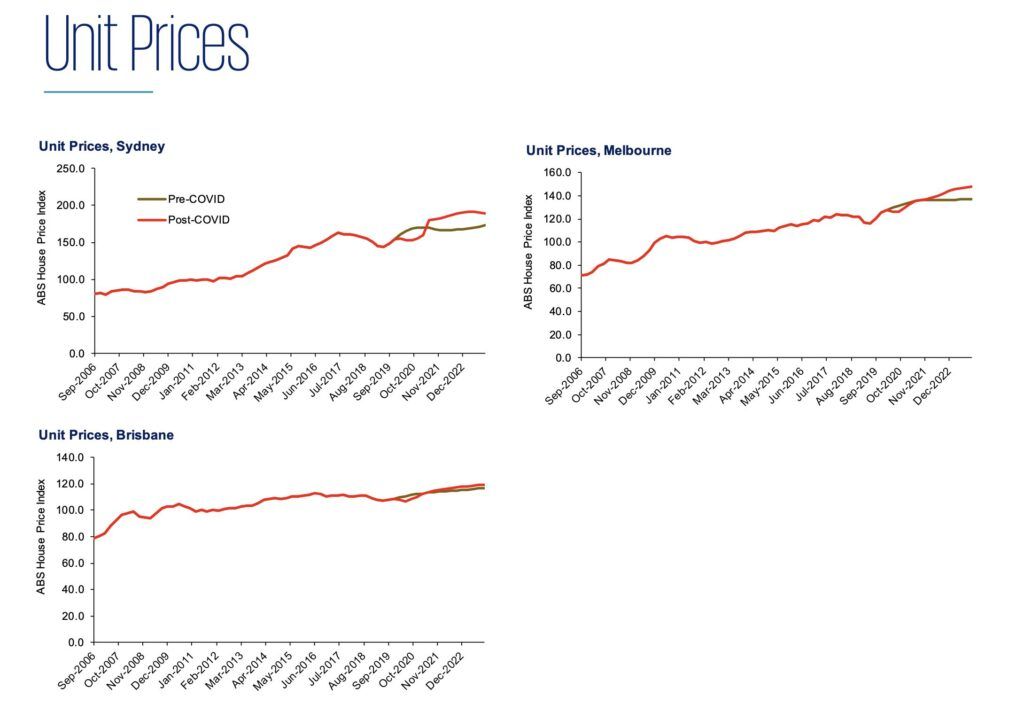

• Notwithstanding this moderating property price growth during 2022 and 2023, KPMG’s analysis shows that house prices are expected to be between 4 percent and 12 percent higher and unit values are expected to be between 0 percent and 13 percent higher than would have been the case in the absence of COVID-19.

In the Pre-COVID-19 scenario all of Australia’s capital cities, with the exception of Darwin, were expected to achieve strong nominal property price growth over the four years of the new decade.

Sydney was on the cusp of a significant price hike. Over time some of this increase would have flowed through to prices in the related markets of Melbourne and Brisbane.

Instead of seeing strong property price growth during the first half of 2020 the onset of the coronavirus pandemic instead saw all Australian housing markets, except Canberra, experience nominal price declines of between -0.3 percent (Hobart) and -2.8 percent (Melbourne) during the June quarter 2020.

In response to the COVID-19-induced economic downturn the Reserve Bank of Australia and the Commonwealth and State governments implemented a range of policy responses to support the domestic economy.

These policies have impacted Australia’s property market directly and indirectly.

KPMG conclusion was

The coronavirus pandemic has disrupted all economies and markets around the world.

Expectations of population growth have been revised as a consequence of disruption to international migration and declining birth rates.

The economic consequences associated with managing the health impacts of COVID-19 has seen some countries apply fiscal and monetary policy stimulus packages to support individuals and markets most negatively affected.

This overlay of declining population growth, increased uncertainty and growing economic disruption paint a picture that is not conducive to nominal price growth in asset markets.

Given these fundamentals Australia saw its stock market experience a freefall in asset values at the start of the pandemic, while residential property prices also experienced nominal declines of around 3% in the June quarter 2020.

Since then we have witnessed a turnaround in the share market, with the All Ordinaries Index pushing record highs on a daily basis, while property markets have seen prices recover and shoot upwards.

In this study KPMG has sought to understand whether property prices are likely to be higher or lower in the post- COVID-19 world relative to the counterfactual scenario where COVID-19 did not occur.

If you wish to read the full report download it here.

KPMG is an Anglo-Dutch multinational professional services network, and one of the Big Four accounting organisations, headquartered in Amstelveen, Netherlands, although incorporated in the United Kingdom.

KPMG is a network of firms in 147 countries, with over 227,000 employees and has three lines of services: financial audit, tax, and advisory.

KPMG Australia is always working closely with economists, developers and demographers to give a holistic view of what is currently happening and predict what may happen in the future.

The next most important thing you need to know about Property is Supply pipeline done by KPMG.

share to