Melrose Park’s transformation from an industrial precinct into a residential and mixed-use community has been a strategically significant shift for Sydney’s urban future. Historically, the area was home to pharmaceutical and light-industrial operations, but over time these industries declined, consolidated elsewhere, or simply outgrew the outdated warehouses and fragmented road layout. Keeping the land zoned industrial would have meant under-utilising a large, strategically located pocket of Sydney at a time when housing demand is at critical levels.

Redeveloping Melrose Park allows Sydney to introduce thousands of new homes in an inner-suburban area without pushing growth further to the city’s outskirts. With capacity for around 10,000–11,000 dwellings, plus retail, open space, a new high school and community facilities, the precinct is envisioned as a self-contained, modern neighbourhood with liveability at its core. Instead of being an isolated residential pocket, Melrose Park is being planned as a walkable, amenity-rich town centre where green spaces, urban parks, and mixed-use buildings form a cohesive and sustainable environment.

Its location is one of its strongest advantages. Positioned on the Parramatta River, the suburb sits almost exactly halfway between Sydney CBD and Parramatta CBD, making it highly attractive for commuters who want balance, convenience and lifestyle. It is minutes from major employment hubs, established transport corridors like Victoria Road, and future connections that will further integrate the precinct into Sydney’s broader network. The land parcel is also unusually large and contiguous for an inner-suburban area, enabling a full masterplan rather than piecemeal development.

Overall, the shift from industrial to residential in Melrose Park wasn’t just a rezoning exercise; it was a strategic realignment of land use to meet Sydney’s changing economic, demographic, and lifestyle needs. Its prime location ensures the precinct will continue to attract demand, support growth, and deliver long-term value for residents and investors alike.

Parramatta Light Rail Stage 2

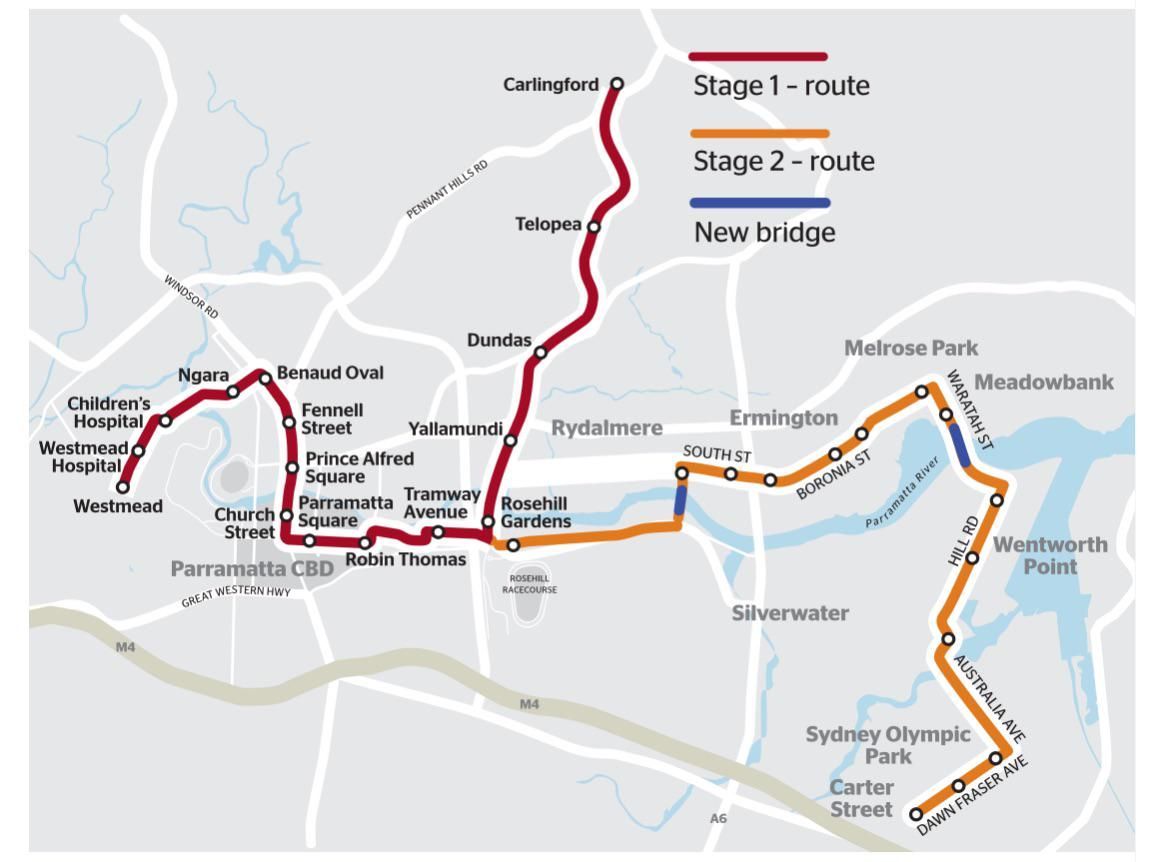

Parramatta Light Rail Stage 2 will extend Stage 1 from Parramatta CBD to Sydney Olympic Park via Camellia, Rydalmere, Ermington, Melrose Park and Wentworth Point. It creates a continuous higher‑frequency public transport spine linking Melrose Park residents directly to Parramatta CBD, Stage 1, and the Olympic Park employment and events hub.

Delivery is staged, starting with “enabling works” including the first 1.3 km of alignment and a 320 m bridge between Melrose Park and Wentworth Point, with design and early works to begin before major bridge construction in 2025. The full light‑rail line and associated public‑domain upgrades will roll out over several years, so the value uplift from true rail operation will occur in phases rather than all at once.

Bridge to Wentworth Point & Olympic Park

The new 320 m bridge across the Parramatta River will carry light rail, buses, pedestrians and cyclists between Melrose Park and Wentworth Point as part of an integrated public and active transport corridor. This is the first major new crossing on this section of the river in decades and will materially shorten access times from Melrose Park to Wentworth Point, Rhodes‑style waterfront amenity and Sydney Olympic Park.

By improving multi‑modal access in both directions, the bridge effectively plugs Melrose Park into the broader Parramatta River “apartment belt” and its jobs, retail and recreation, rather than leaving it as an isolated industrial pocket. Upgrades to local parks such as Archer Park are included in the bridge works, further enhancing amenity around the transport corridor.

Melrose Park master plan

The Melrose Park master plan, led by Sekisui House and others, is a staged $5 billion urban renewal project that will deliver:

- Around 5,500 dwellings and a town‑centre style commercial and retail hub.

- A mixed‑use core with commercial offices, ground‑floor retail and community facilities.

- Three major parks: Central Park (~1.76 ha), Wharf Road Gardens (~2.0 ha) and Western Parklands (~1.5 ha).

- A new school, 10 new streets and substantial public domain upgrades.

Central Park is envisaged as the community’s “heart”, with open lawns, BBQs, children’s play areas, walking tracks and adjoining rooftop communal spaces, while Wharf Road Gardens and Western Parklands extend the green network towards the river and western edge. The precinct is marketed as one of Sydney’s first “smart communities”, featuring EV charging, sensor street lighting, NBN to premises and environmental monitoring integrated into a resident app.

Comparison with Rhodes’ growth

Rhodes has evolved over roughly two decades from industrial land into a dense waterfront suburb where more than 90% of residents now live in high‑rise towers, anchored by Rhodes Central shopping centre, waterfront parks and a heavy‑rail station on the T9 line. The Rhodes Central town‑centre project alone is a multibillion‑dollar redevelopment with a full‑line supermarket, 55+ specialty stores and a significant residential component, illustrating how long it can take to fully mature a new high‑density precinct.

Common elements between Rhodes and Melrose Park include:

- Waterfront or near‑waterfront apartment living on the Parramatta River.

- Large masterplanned scale with thousands of apartments and a town centre.

- Strong public transport: Rhodes has heavy rail, while Melrose Park will rely on light rail plus bus and road links.

- Integrated parks, foreshore or river‑adjacent open space and dining precincts.

A key difference is that Rhodes benefits from an existing heavy‑rail station and is already fully embedded in Sydney’s rail network, whereas Melrose Park’s uplift depends on the successful delivery of a new light‑rail line and bridge. Rhodes also has a more established retail catchment and workforce using the station, while Melrose Park is still in early‑ to mid‑stages of its 15‑year build‑out.

Why the growth will take time

Several factors mean Melrose Park’s full potential will likely emerge over a decade or more rather than in a short burst:

- Staged 15‑year construction: The master plan is explicitly structured as a long program to maintain design quality, so delivered stock, amenities and price discovery will come in waves.

- Transport timing: The light‑rail enabling works and bridge start around 2025, but full line opening and patronage ramp‑up will take additional years, delaying the peak transport‑driven premium.

- Absorption and competition: 5,500 dwellings is a large volume to be absorbed, and Melrose Park competes with Rhodes, Wentworth Point and other riverfront apartment markets, moderating short‑term price spikes.

- Macro cycles and policy: Interest‑rate cycles, build costs and planning/process risk can slow construction or staging decisions, stretching the timeline between rezoning and full realisation.

From an investment perspective, this points toward a long‑term, staged‑growth thesis similar to early‑Rhodes or early‑Wentworth Point, where the strongest premiums arrived after critical mass in population, transport and retail amenity was achieved.

Who is moving there

Demographic data for Melrose Park and the immediate study area show a relatively young, affluent and renter‑heavy market compared with Greater Sydney. Profiles highlight:

- A high share of established white‑collar families aged 35–54, often with school‑aged children.

- A sizeable group of comfortable retirees in higher‑value properties, plus a growing cohort of millennial first‑home‑buyer professionals.

Urbis research on the Melrose Park catchment notes a much higher proportion of residents aged 25–39, a larger share of tertiary students, and incomes around 9% above the Greater Sydney average, with about 53% of households renting versus 36% across Sydney. This combination points to demand from young professionals and downsizers who value proximity to jobs and education, and from investors targeting an affluent, stable tenant pool close to major employment and study centres.

Quality of new construction

The flagship Melrose Park North project is being delivered by Sekisui House Australia with partners, with “Dawn” as the fifth stage and a key benchmark for construction quality in the precinct. Dawn is marketed as holding a 4 Gold Star iCIRT rating (a NSW government‑endorsed independent rating system) for developer integrity, capability and financial strength, signalling a higher standard of governance, design and delivery than many legacy Sydney apartment projects that lack such accreditation.

Marketing and project updates emphasise sustainability features, extensive landscaping, rooftop gardens, podium parks and energy‑efficient building systems, consistent with Sekisui House’s global design philosophy and its track record on other masterplanned communities.

While quality can vary between different developers and future stages, the leading precinct developer sets a high bar for materials, finishes and common areas, which is a positive indicator for long‑term durability and resident experience compared with older walk‑ups or lower‑spec infill projects.

For investors paying attention to supply/demand dynamics, precincts like Melrose Park may offer a potential first-mover advantage (buying on early release, before full amenities, before prices fully reflect future potential). Especially following the good developers.

What to know more about this? Get in touch.

share to