On 12 August 2025, the Reserve Bank of Australia (RBA) made a move that’s already sending ripples through the housing market — another 25 basis point cut to the cash rate, bringing it down to 3.60%. This marks the third cut this year, with the RBA pointing to cooling inflation (headline at 2.1%, underlying at 2.7%) and a softer labour market as key reasons for easing monetary policy.

The good news for borrowers came quickly. All four of Australia’s big banks — CBA, NAB, Westpac, and ANZ — wasted no time in passing on the cut to variable home loan customers. For many households, this means hundreds of dollars in monthly savings. On a $500,000 mortgage, the reduction could save around $272 a month, or over $3,300 a year. For those with a $700,000 loan, the annual savings are closer to $1,100. That’s money that can make a real difference to household budgets, and it could also play a big role in shaping property demand.

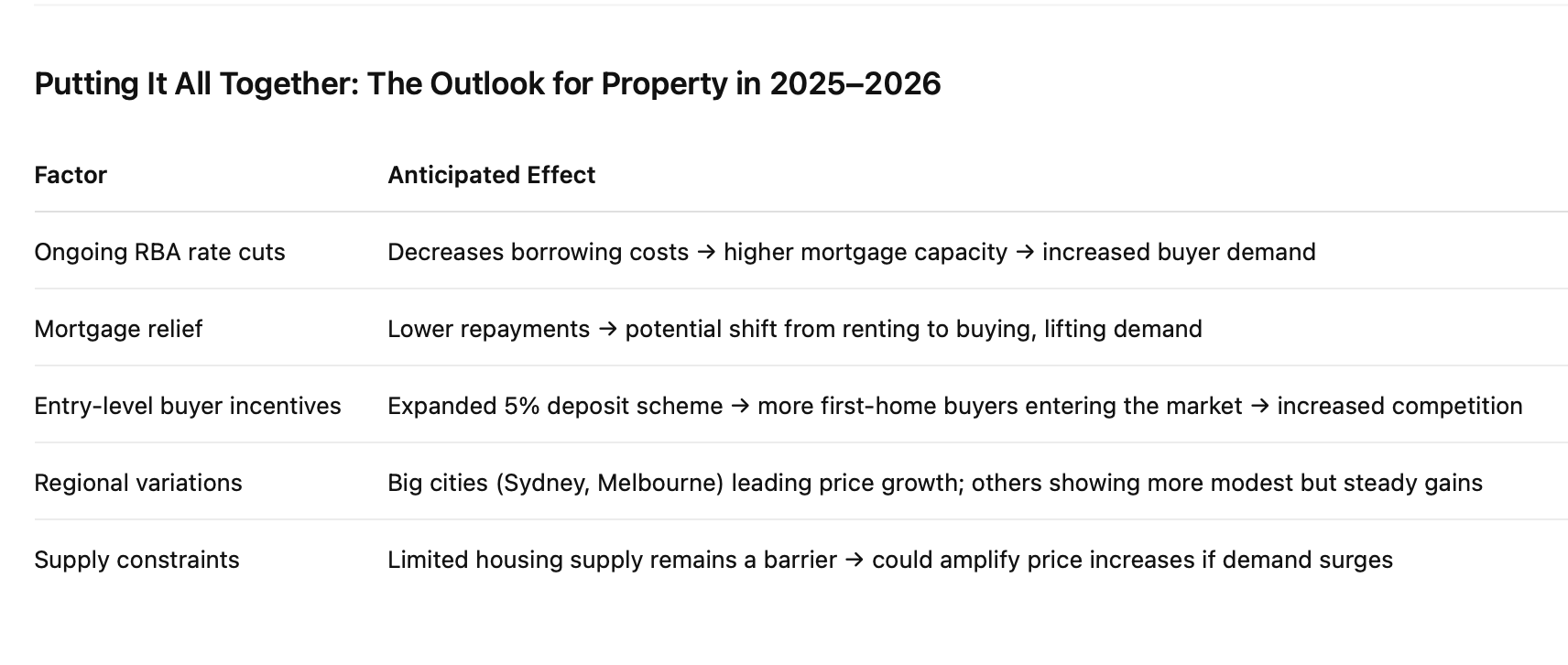

Lower interest rates have always had a habit of stirring up the housing market. When borrowing becomes cheaper, more buyers can step in, and many can stretch their budgets further. Analysts are already predicting a lift in prices. Some forecasts suggest a 6–10% increase nationally by early 2026, while others, like Domain’s Tulip model, point to gains of up to 12% — which could add a staggering $141,000 to median capital city prices if cuts continue into next year.

Sydney and Melbourne are tipped to lead the charge. KPMG expects Sydney prices to rise 3.3% in 2025 and then accelerate to 7.8% in 2026. Melbourne could see similar momentum, with 3.5% growth this year and 6% next. By June 2026, the median Sydney house price could hit $1.83 million, while Melbourne’s could push past $1.1 million. Even now, Sydney values are already up 6.5% for the year, and loan sizes are creeping higher, with the national average now around $678,000.

As if cheaper borrowing wasn’t enough to heat things up, January 2026 is set to bring another wave of market-changing policies. The government will expand the 5% Deposit Guarantee Scheme to all first-home buyers, regardless of income, and raise the property price caps. Buyers using the scheme won’t need to pay Lenders Mortgage Insurance (LMI), which can save tens of thousands of dollars. This is a massive boost for first-home buyers, and it’s likely to draw even more competition into an already tightening market.

There’s also a two-year ban on foreign buyers purchasing established property, which remains in place until at least 2027. While this may reduce some competition at the high end, the effect at the entry level could be the opposite — more local buyers fighting for the same limited stock. With supply still struggling to keep up with demand, the combination of rate cuts and policy changes could create a perfect storm for price growth.

So, what does this mean for you? If you’re a homebuyer, you may find that while the cost of borrowing falls, the race to secure a property gets tougher. The months ahead could see open homes buzzing with more buyers, auctions heating up, and prices edging higher. For sellers and investors, however, the landscape is looking promising. The mix of cheaper finance, expanded buyer incentives, and persistent supply constraints is setting the stage for potentially significant gains in property values.

Whether you’re buying, selling, or just watching from the sidelines, one thing is clear — the next 18 months in Australian real estate are going to be anything but dull.

This is why you need someone in your corner to help you navigate the crazy times ahead.

Book a complementary call and lets have a chat and see how we can assist you.

share to