In the current Australian property landscape, investors continue to debate whether it’s better to purchase an affordable home in a regional area or commit to a more expensive property in one of the capital cities like Sydney, Melbourne, or Brisbane.

Both strategies have merit—but they also carry unique risks and rewards. As the market shifts in 2025, understanding how these investment paths differ is critical to making the right move for your portfolio.

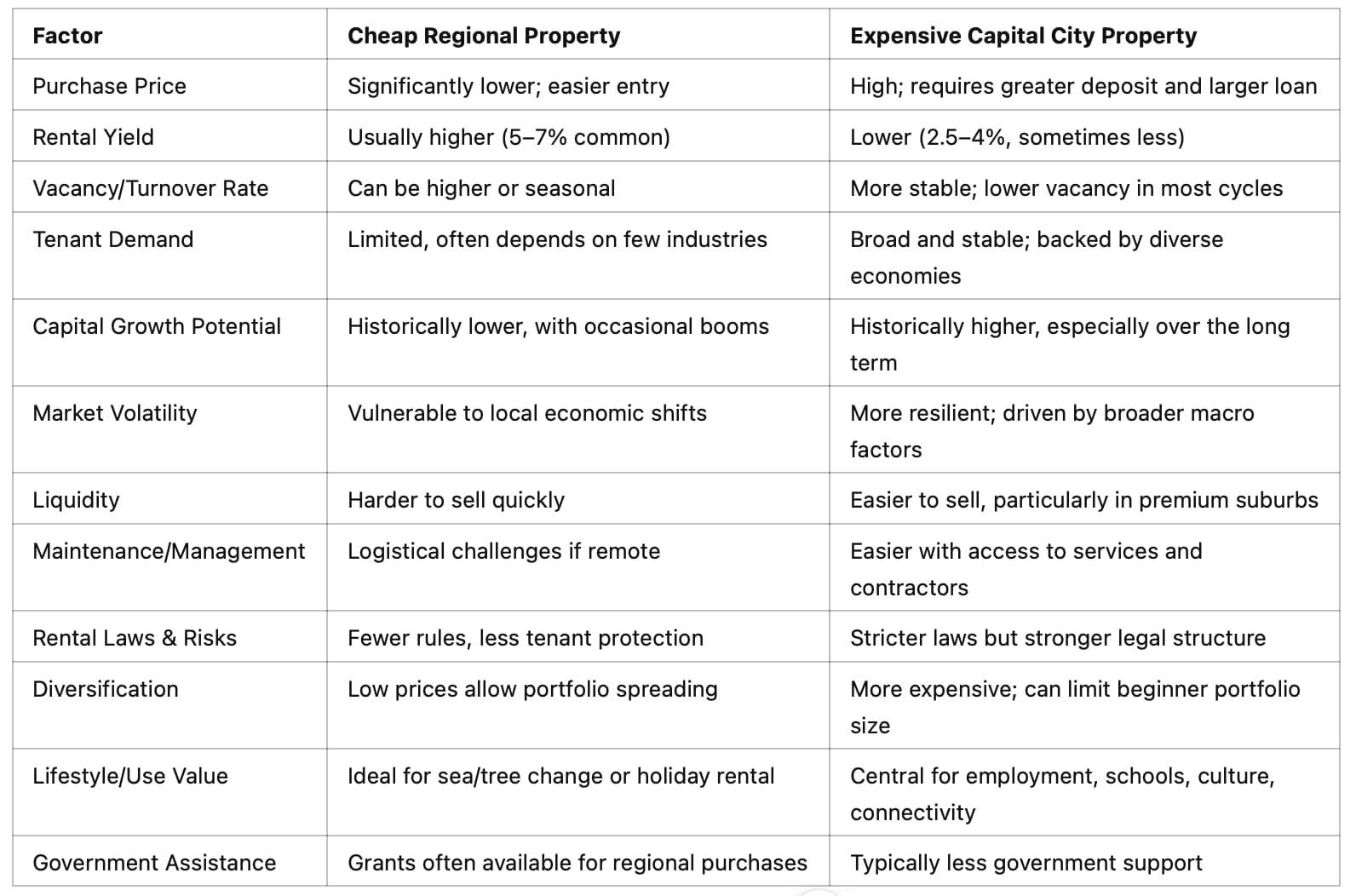

Let’s walk through a comprehensive side-by-side comparison and outline the factors that should influence your decision.

Comparing the Key Investment Metrics

At a glance, here’s how regional and capital city investments stack up in terms of price, returns, risk, and growth potential:

When Does a Regional Investment Make Sense?

While regional areas might seem less glamorous than Sydney’s Eastern Suburbs or Melbourne’s inner north, they do offer advantages—especially for certain types of investors.

If you’re looking for high rental yields, a more accessible entry point, or want to diversify quickly with multiple lower-cost assets, regional towns can make a lot of sense. These locations often offer yields of 5–7%, especially in towns with improving infrastructure or population growth.

However, the trade-off is exposure to higher vacancy risk, limited job markets, and the possibility of “boom-and-bust” pricing tied to single industries.

This strategy works best if you’re:

• Comfortable with higher short-term risk

• Able to closely manage your properties or hire a strong local manager

• Investing in towns with planned growth and diverse employment bases

When Is a Capital City Property the Better Bet?

Capital cities have long been viewed as the anchor of stable wealth creation in property. While yields are often lower—sometimes under 3%—these areas deliver consistent long-term capital growth, superior infrastructure, and strong liquidity when it comes time to sell.

For investors who value low vacancy, better tenant quality, and access to public transport, schools, and jobs, capital cities continue to outperform in the long run.

This approach is suited for investors who:

• Want a lower-risk, growth-focused portfolio foundation

• Can manage short-term negative cash flow or lower returns

• Plan to hold the asset for the long haul

• May want flexibility to sell quickly in future

Questions You Should Ask Before Choosing

There’s no one-size-fits-all strategy. The right choice depends on your financial position, goals, and risk appetite.

Ask yourself:

• Am I focused on cash flow now or capital growth over time?

• Can I handle vacancies or tenants in remote areas?

• Do I want to manage multiple properties or stick with one strong investment?

• How familiar am I with the area? Do I have local knowledge or trusted partners?

• What’s the local economy based on—and how diversified is it?

The answers to these questions will help shape your strategy and avoid costly mistakes.

Real-World Scenarios

Case A: Investor with $150,000 Deposit

Regional Options:

- Victoria:

Buy two houses in high-yield regional towns—e.g., Ouyen ($250,000, 8.8% yield) or Warracknabeal ($320,000, 8.7% yield). Each property offers strong rental returns and a lower entry price, allowing portfolio diversification. - New South Wales:

Buy two houses in top-yielding regional towns—e.g., Broken Hill ($201,000, 11.0% yield) or Lightning Ridge ($335,000, 10.6%)—enabling dual-property ownership with excellent cash flow potential and affordable purchase costs.

Summary of regional strategy:

This approach offers higher immediate cash flow (with gross yields between 5.4%–11%), diversification (owning in different markets), and a lower financial barrier to entry.

However, it comes with higher tenant risk, potential for longer vacancies, and possible market volatility if local economies falter.

Major Capital City Option:

- Victoria:

Use the $150,000 deposit to purchase a 1-bedroom unit on Melbourne’s fringe or an affordable inner suburb (e.g., Albion, median unit price $350,000, 4.7% yield; or standard 1-bed unit in outer metro areas at $350,000–$450,000, typical yield ~4.2–4.7%). - Sydney (NSW):

Entry-level 1-bedroom units in western fringe suburbs like Rosehill (median $530,000, yield 6.2%) are possible but would likely require stretching deposit and borrowing more. Yields in the city tend to be lower (3–4% typical) but offer long-term capital stability and easier liquidity.

Summary of city unit strategy:

Buying in a capital city offers better long-term capital growth prospects, more stable tenant demand, and quicker potential resale.

Cash flow will be lower than in top regional towns, but capital gains and liquidity are stronger over the long run.

Case B: Investor Prioritising Ultra-Low Risk and Easy Future Sale

- Victoria:

Favour a blue-chip suburb in Melbourne, such as a well-established inner or middle suburb (e.g., Carlton, Richmond, or Brunswick for units), where the market is deep, demand is steady, and resale is relatively quick—even in downturns. Expect to pay more for lower risk and accept lower yields (~3–4.5%). - NSW:

In Sydney, prioritise established, sought-after unit markets on transport lines—e.g., lower north shore, inner west. Offers excellent tenant security, but yields are typically low, and entry price is high.

How to Choose

- Regional (Vic/NSW): Suited to value-driven investors seeking higher yield, willing to accept more management effort, and who don’t need immediate liquidity or guaranteed quick resale.

- City unit (Vic/NSW): Best for risk-averse investors seeking stability, ease of sale, and market diversity but who are comfortable with lower rental income relative to property price.

Always consider the local economy, employment base, tenant demand, and property management infrastructure—and seek independent advice before buying.

What is the right strategy?

There’s no universal “right” answer in the regional vs capital city debate. Regional property offers strong cash flow and accessibility, while capital cities provide long-term value, liquidity, and consistency.

For most investors, a balanced portfolio—with regional properties for yield and capital city holdings for stability—can deliver the best of both worlds.

Before you commit, make sure to research each market thoroughly, understand the risks, and consider what role the property will play in your broader strategy.

At PB Property we can assist you with your decision making process and with the sourcing of the properties. Just Book a call here.

Disclaimer:

This article is provided for general informational purposes only and does not constitute financial, legal, or investment advice. While every effort has been made to ensure the accuracy of the information at the time of writing, readers should conduct their own research and seek advice from a qualified professional before making any financial decisions. PB Property does not accept any liability for losses incurred from actions taken based on the content of this article.

share to