In an era where sustainability and savings go hand in hand, green home loans are making a quiet revolution in Australia’s property landscape. Whether you’re building your first home, investing in a house and land package, or upgrading an existing property, a high energy efficiency rating could translate into significant mortgage discounts.

But what’s behind this green finance movement? And how can you take advantage of it as an investor or homebuilder? Let’s break it down.

What Is a Green Home Loan?

Green loans are specially designed home loan products that reward energy-efficient building choices. Offered by many Australian lenders, they provide lower interest rates for homes that meet certain environmental standards—typically those rated highly under the Nationwide House Energy Rating Scheme (NatHERS).

With interest rates ranging from as low as 2.79% in 2025, green loans are not just good for the planet—they’re great for your budget.

What Is NatHERS?

The Nationwide House Energy Rating Scheme (NatHERS) is a government-endorsed system that measures how energy-efficient a home is. Ratings range from 0 to 10 stars, with a 7-star rating or higher often being the minimum threshold for accessing green loan discounts.

A high NatHERS rating means:

• Lower heating and cooling costs

• Reduced carbon footprint

• Enhanced long-term property value

To qualify, your home must be rated by an accredited NatHERS assessor, and the certificate must be provided to your lender.

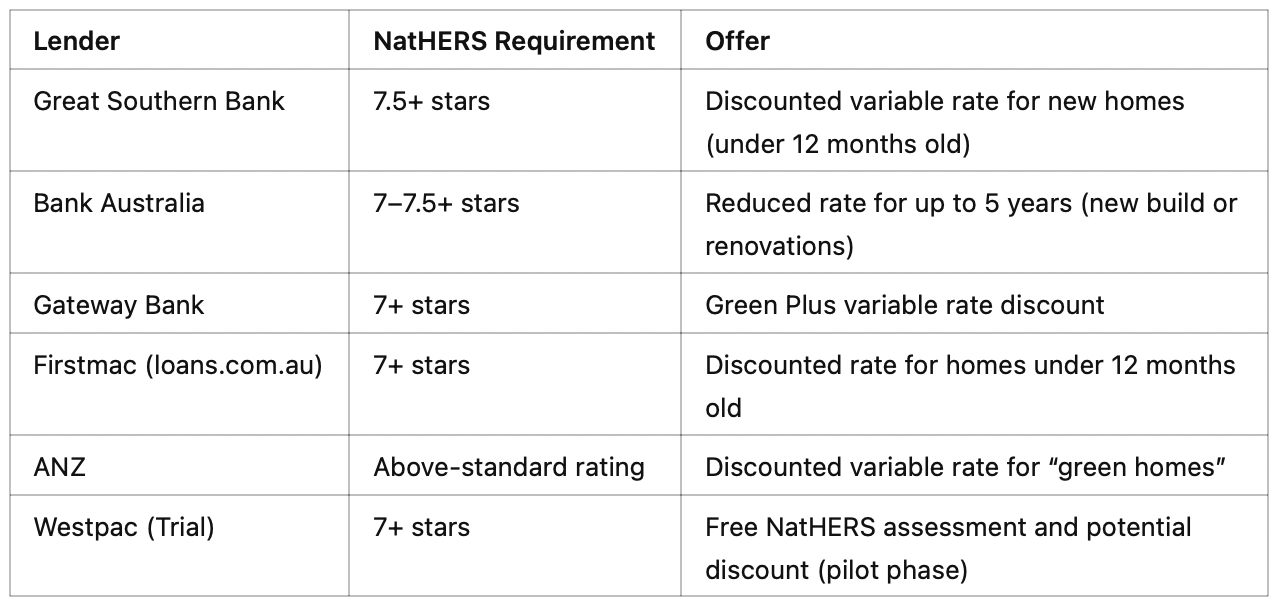

Banks Currently Offering Green Loan Discounts

More and more lenders are jumping on board. Here’s a snapshot of what some of them are offering in 2025:

Features of Green Home Loans

• Discounts of 0.05% to 0.25% below standard rates

• Typically apply to variable rate loans, though some lenders offer fixed or introductory green rates

• Can be combined with features like offset accounts, redraw, and flexible repayment options

• Some loans also apply to renovations or retrofits, not just new builds

How to Qualify for a Green Home Loan

1. Build or buy a NatHERS-rated home (7.0+ stars)

Start with energy-efficient design and materials, working with a builder who understands sustainability and NatHERS compliance.

2. Obtain a NatHERS certificate

This must come from an accredited assessor and be included in your loan application.

3. Apply with a lender offering green loan options

Submit your plans or certificate to secure the discount. For new builds, discounts are typically confirmed once construction is complete and the rating is verified.

At PB Property we recommend using a Mortgage Broker as they will be able to assist you with the best product and a more personalised approach.

We have a panel of qualified independent Mortgage Brokers that we can refer you to and make this process smooth.

Why Are Banks Offering These Discounts?

Aside from environmental responsibility, lenders have real financial motivations for offering green loan incentives:

• High-rated homes cost less to run, lowering default risk

• Higher resale value enhances loan security

• Aligns with ESG commitments and government net-zero targets

The Bottom Line: Sustainability Pays

Green home loans are not just a trend—they’re a smart financial move for investors and homeowners looking to future-proof their properties and reduce costs. With banks now actively supporting sustainable housing, the opportunity to benefit from energy-efficient design has never been greater.

How PB Property Can Help You Invest Smarter

At PB Property, we go beyond just sourcing land—we work hand-in-hand with investors to ensure their house and land packages are designed for both sustainability and financial performance.

Here’s how we can support your green investment journey:

• Connect you with expert builders who understand the NatHERS rating system and can deliver homes with 7.0–7.5+ stars

• Guide your design process to ensure compliance with lender requirements for green loans

• Maximise your financing options by helping you qualify for interest rate discounts through energy-efficient building choices

• Future-proof your investment by building homes that appeal to eco-conscious buyers and tenants, all while saving you money

Ready to Build Smarter?

Let us help you create a home that’s efficient, bank-friendly, and investment-ready.

Contact PB Property today and ask how we can help you build a NatHERS-rated home that qualifies for a green loan and sets your portfolio up for long-term growth.

share to