What is LMI (Lenders Mortgage Insurance) and how it works in Australia

Lenders Mortgage Insurance (LMI) is an insurance policy that protects the lender if a borrower with a small deposit defaults. It’s triggered when your Loan-to-Value Ratio (LVR) is above roughly 80% — i.e., you put down less than 20% deposit. Important to be clear: LMI protects the bank, not you. This what the 5% deposit scheme basis it self on in order to assists new buyers into the market. However it os really helping?

How you pay for it

- Upfront: You can pay LMI as a once-only fee at settlement from your savings.

- Capitalised: More commonly, lenders allow you to add the LMI premium to the loan principal. That means you pay interest on the LMI amount over the life of the loan.

- Lender-paid LMI: Some lenders offer “lender-paid” LMI where they cover the premium but charge a higher interest rate instead. This shifts the cost into interest rather than a direct fee.

How LMI is calculated

The premium depends on the LVR and the loan size: higher LVRs and larger loans attract larger premiums. Each insurer has banded pricing structures.

How to take advantage of LMI (legitimately)

- Buy sooner: LMI lets borrowers enter the market earlier with a smaller deposit.

- Use it strategically with an investment plan: if the purchase cash flows and growth projections stack up, LMI can speed up wealth-building.

- Alternatives: consider a family guarantee (using a parent’s property as extra security) to avoid LMI, or negotiate lender-paid LMI if you prefer to trade a fee for a slightly higher rate.

- Shop around: LMI premiums and lender policies differ; a broker or buyers’ agent can help find the cheapest practical option.

Why are people scared of LMI and what do mortgage brokers say?

People are scared of what they don’t understand and most of the time they are dealing with brokers that might not have the experience to advise them by looking at the big picture. All they focus on is the extra cost, the fact that LMI protects the lender not them instead of taking into consideration the opportunity cost.

When talking toJohn Kim, an experienced mortgage broker and partner at Byrons, we asked what he thinks about LMI and should people stir away from it?

This is what he had to say:

“Too many people see LMI as a ‘penalty’ for not saving 20% but in reality it can be a strategic tool.

Yes, LMI protects the lender, not you. But if it helps you get into a rising market 6–12 months earlier or secure a strong cash-flowing property while building equity, the cost of LMI can often be far less than the opportunity cost of waiting.

I’ve helped many clients over the years who’ve paid $10–20K in LMI but gained $100–200K in property value and rental income over the next 2 years. Or some clients accelerate growing their investment portfolio by buying 2 properties instead of one using LMI.

It’s important to think big picture and long term when looking at property.

Of course, if you can avoid it using family guarantee or government schemes then you would do that. It’s not for everyone but if you’re buying smart, have buffers in place, and your borrowing strategy is tailored to your goals, then LMI shouldn’t be something to fear, it should be something to evaluate.”

Does LMI get “diluted” over a 30‑year loan?

- LMI itself is a one‑off premium. If you pay it upfront, it’s a sunk cost and doesn’t “dilute” — it’s just a fixed fee.

- If you add LMI to your loan, its relative impact reduces over time as you repay the loan (i.e., the premium becomes a smaller portion of the outstanding balance). But remember you also pay interest on it, so the total cost can be higher over 30 years.

- In short: the dollar amount doesn’t vanish; its proportional effect on cashflow usually lessens over decades, but you still bore the cost.

Tax and refunds

- Tax: For owner-occupiers, LMI is generally not tax-deductible. For investment loans, parts or all of LMI may be deductible or claimable — check with an accountant.

- Refunds: LMI is usually non-refundable. In rare cases you might be eligible for a rebate if you cancel or refinance under certain conditions; this depends on the insurer and lender.

Pros and cons of LMI

Pros

- Allows earlier entry to the property market with a smaller deposit.

- Can accelerate wealth-building if the purchase performs well.

- Keeps your savings intact for other uses (emergencies, renovations, investment).

Cons

- Extra upfront cost or added loan principal + interest.

- Protects lender, not borrower, no compensation if you default.

- Can be substantial for high-value loans with high LVRs.

Bottom line: LMI isn’t a villain — it’s a trade-off. It’s useful when the numbers make sense, but it’s not a free pass. Run the math, talk to a broker or accountant, and don’t assume LMI is “diluted away” without cost.

Case Study

In order to help you better understand lets use the following scenario with the assumptions below:

Assumptions

- Purchase price: $1,000,000 (NSW).

- Deposit: 10% = $100,000 → loan required $900,000 (90% LVR).

- Loan term: 30 years, fixed example interest = 5.00% p.a. (used only to show cost of capitalising LMI).

- Indicative LMI premium for 90% LVR on a $1M purchase (owner-occupier): $26,000 (conservative illustrative figure based on historical insurer bands — actual premium set by insurer such as Genworth/QBE and the lender).

- NSW stamp duty rates used (owner-occupier): stamp duty on $1,000,000 = $40,490.

- Other typical fees estimated.

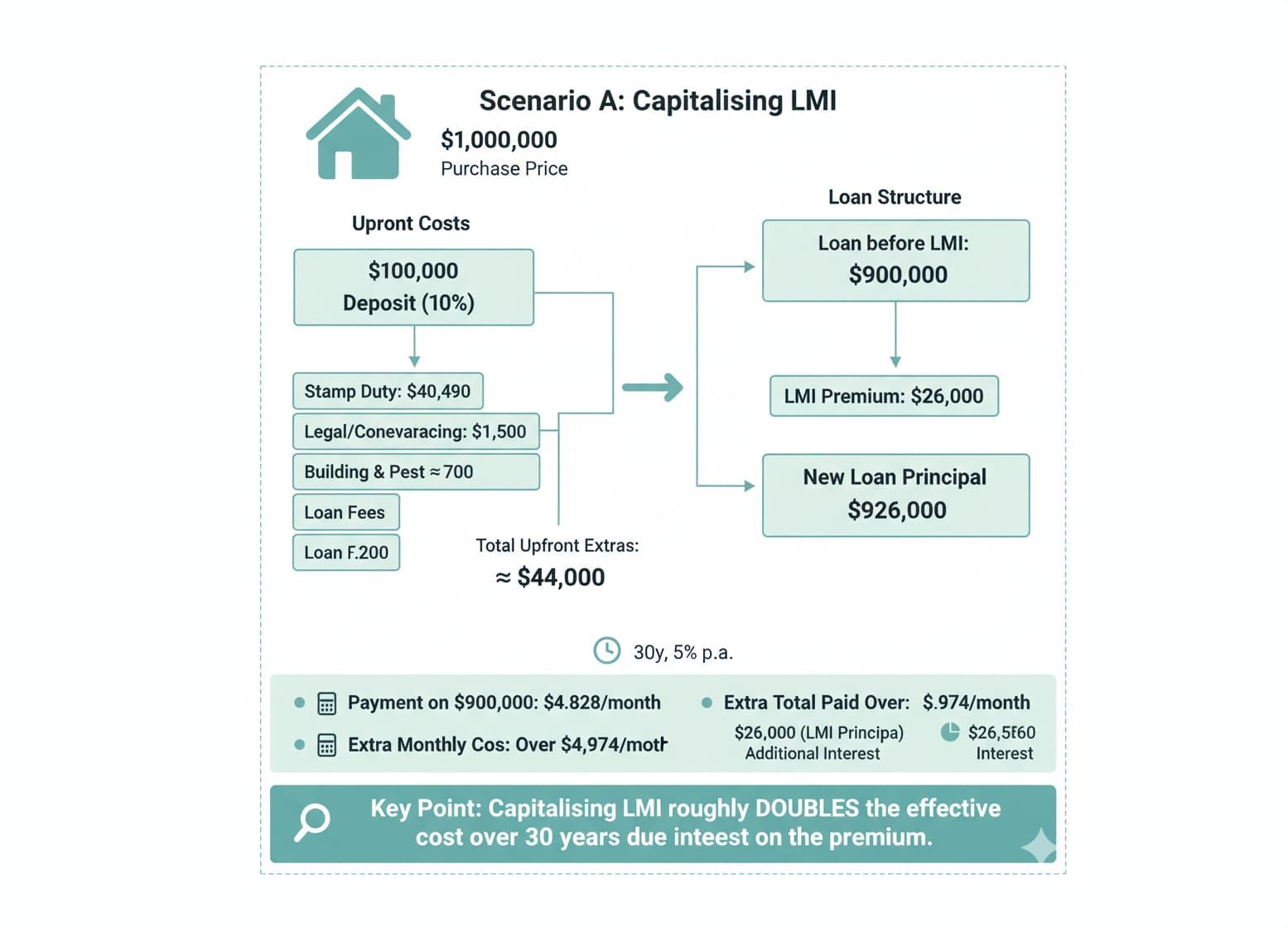

Scenario A — Buy now with 10% deposit, capitalised LMI

- Purchase price: $1,000,000

- Deposit: $100,000

- Loan before LMI: $900,000

- LMI premium (capitalised): $26,000

- New loan principal = $900,000 + $26,000 = $926,000

Upfront / one‑off costs (typical, NSW)

- Stamp duty: $40,490

- Legal/conveyancing: $1,500 (estimate)

- Building & pest inspection: $700 (estimate)

- Loan application/fees and registrations: $1,200 (estimate)

- Total upfront extras (excluding deposit): ≈ $44,000

Monthly repayment comparison (30y, 5% p.a.)

- Payment on $900,000 ≈ $4,828 / month

- Payment on $926,000 ≈ $4,974 / month

- Extra monthly cost from capitalising LMI ≈ $146 / month

- Extra total paid over 30 years ≈ $146 × 360 = $52,560

- Of that, $26,000 is the capitalised LMI principal; the rest ≈ $26,560 is additional interest paid because you capitalised the LMI.

Key point: capitalising LMI spreads the premium, but you pay interest on that premium for the life of the loan, roughly doubling the effective cost over 30 years in this illustration.

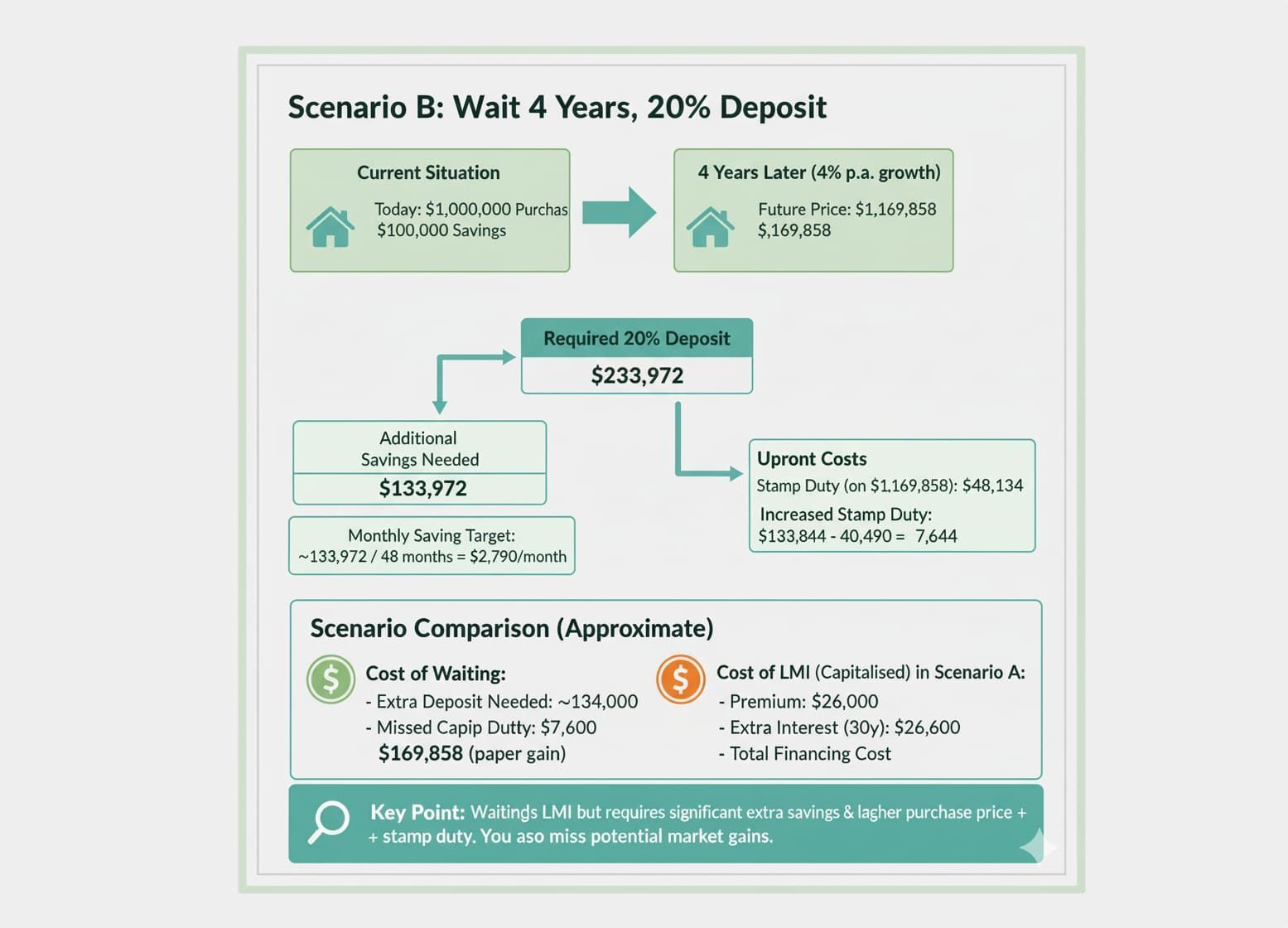

Now lets run it differently and instead of getting LMI you then wait an additional 4 years to be able to save another 10%, most people would take even more time but lets use 4 years for this example. We will use a conservative low growth rate of 4% p.a.

Scenario B — Wait 4 years to save a 20% deposit while the market grows 4% p.a.

- Price growth 4% p.a. for 4 years → future price = 1,000,000 × (1.04^4) ≈ $1,169,858

- Required 20% deposit at that future price ≈ $233,972

- If you currently have $100,000, you must save ≈ $133,972 over 4 years (~$33,493 pa or ~ $2,790 / month), ignoring potential interest earned on savings.

- Stamp duty at future price (~$1,169,858): duty ≈ $48,134 (using same NSW scale) → stamp duty increases by ≈ $7,644 versus buying now.

Compare outcomes (straight comparison)

- If you buy now, you pay LMI ≈ $26k (plus interest cost ≈ $26.6k over 30y if capitalised), but you secure today’s price and capture any future capital growth.

- If you wait 4 years to avoid LMI and reach 20% deposit, the purchase price likely rises ~17% (in this example), so the cash needed increases significantly (you need to save ~A$134k more plus you face higher stamp duty). You also miss any capital gains that accrue in the meantime. And miss out on being able to buy in the location you want as prices would have gone up.

Quick numeric takeaway (approximate)

- Cost of LMI (capitalised) now: $26k premium + ~$26.6k extra interest over loan = ~$52.6k total financing cost (spread over loan life).

- Cost of waiting: need to find/save an extra ~$134k deposit and pay ~$7.6k more stamp duty — and you miss ~$169,858 in paper capital growth if market really rises 4% p.a.

Other caveats and points

- LMI often isn’t tax-deductible for owner-occupiers. If you convert the property to an investment later, tax treatment may change — get an accountant’s advice.

- Some lenders offer lender‑paid LMI (higher rate instead) or family guarantees to avoid LMI; shop around via a mortgage broker.

- LMI is set by insurers and varies by loan size, LVR, owner‑occupier vs investment status and insurer pricing — the $26k used is illustrative only.

- Market returns are uncertain — the 4% p.a. assumption is hypothetical; downside risk exists.

Bottom line

Paying LMI can be a cheaper path to entering the market now, maybe in a location you desire, or for a good investment and capital growth opportunity, than waiting and facing higher prices and stamp duty — but capitalising LMI increases long‑term interest costs.

Whether to pay LMI or wait depends on your capacity to save, risk tolerance, expected market movement and tax/loan strategy. Get a lender quote and talk to a broker/accountant for a tailored decision. At

PB Property we are connected to a wide variety of great professionals that we would love to introduce to you.

share to