Many people believe that the suburb they live in is the best place to invest in real estate. This bias is deeply rooted in our psychology—familiarity breeds comfort, and comfort breeds confidence. But when it comes to making money in property, this emotional attachment can be costly. Let’s explore why mixing your owner-occupier home with your investment strategy is a mistake, and how data-driven decisions can lead to far greater financial outcomes.

Most homeowners have a strong emotional connection to their property and suburb. It’s where they’ve built memories, raised families, and established routines. This attachment often leads to the belief that their area is the best place to invest. They see local cafes bustling, parks well-kept, and property prices rising, and assume these are universal indicators of investment potential.

However, the reality is that the best place to live is rarely the best place to invest. Owner-occupiers buy homes based on lifestyle, proximity to work, schools, and social circles. Investors, on the other hand, should buy based on numbers—capital growth, rental yield, vacancy rates, and market health indicators.

Mixing Emotions with Investment

When people buy their home with the intention of making money, they often conflate lifestyle factors with investment fundamentals. They justify paying a premium for a property in their preferred suburb, believing it will deliver strong returns simply because it’s desirable to them. This is a classic example of confirmation bias—seeking out information that supports their existing beliefs and ignoring data that contradicts them.

But if you truly want to make money in real estate, you need to separate your emotional needs from your financial goals. The suburbs that offer the best lifestyle are not always the ones that offer the best returns.

The Owner-Occupier vs. Investor Dilemma

An owner-occupier purchase is driven by lifestyle: proximity to family, schools, work, and community. These are valid, but they’re emotional drivers.

An investment purchase, however, should be driven by one question: “Where will my money work hardest for me?”

Take this common mistake: a family buys in their local suburb thinking, “This area has gone up in value for years, so it must keep going up.” But property markets don’t move in straight lines. Growth is cyclical. What was hot five years ago might underperform in the next five.

If the same family had looked beyond their backyard and invested based on growth scores, yield, and market health indicators, they could have spent less upfront and gained far more equity over time.

When people buy their home with the intention of making money, they often conflate lifestyle factors with investment fundamentals. They justify paying a premium for a property in their preferred suburb, believing it will deliver strong returns simply because it’s desirable to them. This is a classic example of confirmation bias—seeking out information that supports their existing beliefs and ignoring data that contradicts them.

But if you truly want to make money in real estate, you need to separate your emotional needs from your financial goals. The suburbs that offer the best lifestyle are not always the ones that offer the best returns.

The Power of Data: Capital Growth Scores

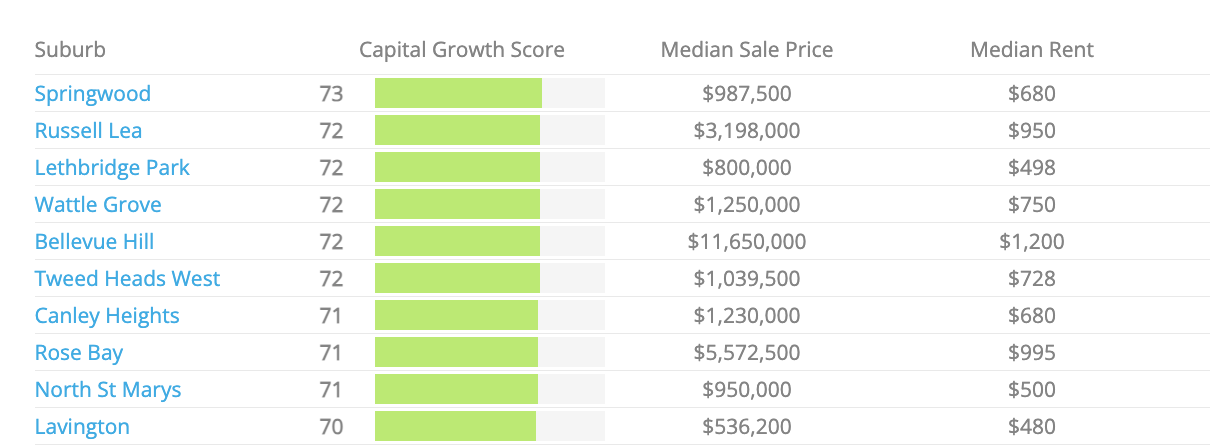

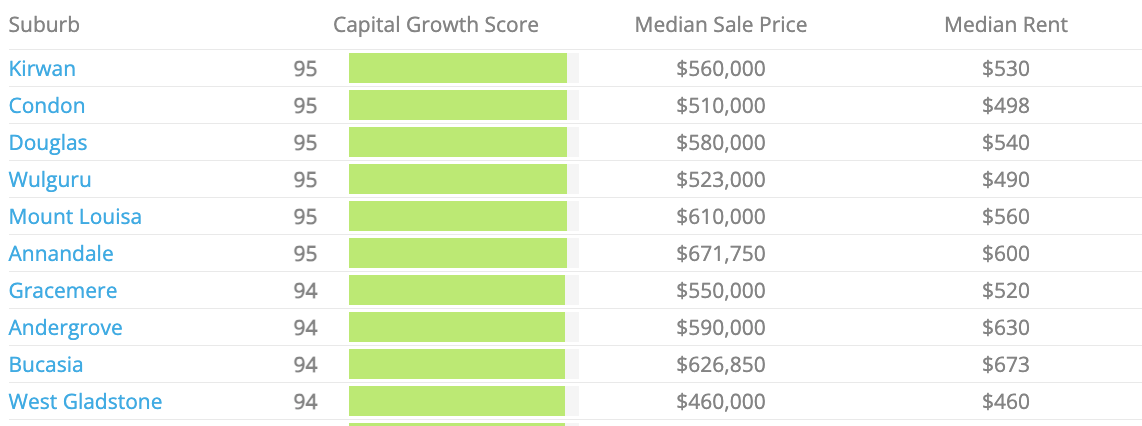

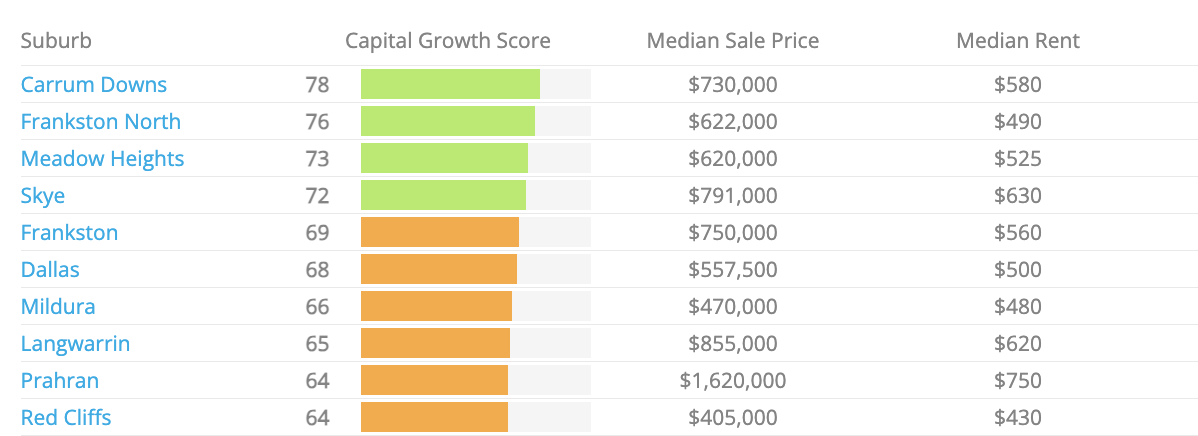

Let’s look at some hard data. The images above show the top 10 capital growth suburbs in NSW, QLD, and VIC, based on Cotality (formerly CoreLogic) data. Cotality is a leading provider of property analytics in Australia, offering comprehensive insights into market trends, capital growth, and rental yields. Their Capital Growth Score is calculated as the average of all individual property scores in a suburb, reflecting recent growth and the short-term outlook based on market health indicators.

Top Ten Suburbs in NSW

Top Ten Suburbs in QLD

Top Ten Suburbs in VIC

A higher score means the suburb has experienced significant capital growth and is likely to continue performing well. This is not a subjective measure—it’s based on rigorous analysis of sales data, price movements, and market fundamentals.

Cotality’s data is invaluable because it strips away the emotion and provides a clear, objective view of the market. It aggregates thousands of transactions, analyzes trends, and delivers actionable insights. Investors who rely on this data can identify suburbs with strong growth potential, high rental yields, and low vacancy rates—regardless of their personal preferences or biases.

By focusing on the numbers, you can invest less and make much more. Instead of pouring hundreds of thousands of dollars into a prestige suburb with mediocre growth, you can target emerging areas with strong fundamentals and watch your investment grow.

How to get it right?

This is where a property buyers agent becomes essential. Buyers agents have access to proprietary data, market reports, and analytics that the average investor cannot easily obtain. They are trained to interpret this information, identify opportunities, and negotiate the best deals. Most importantly, they are not emotionally invested in the outcome—they make decisions based on facts, not feelings.

A good buyers agent will help you:

Define your investment goals

Analyze market data and trends

Identify high-growth suburbs

Assess rental yields and vacancy rates

Negotiate favorable terms

Avoid common pitfalls and emotional traps

The belief that your own suburb is the best place to invest is a comforting illusion, but it’s rarely supported by data. By separating your owner-occupier needs from your investment strategy, and relying on objective market analysis, you can achieve far greater financial success. Cotality’s Capital Growth Scores provide a powerful tool for identifying the best suburbs for investment, and a property buyers agent can help you navigate the market with confidence.

Don’t let emotion dictate your investment decisions. Trust the data, seek expert advice, and invest where the numbers make sense—not where your heart tells you to. In real estate, the smartest money is always made by those who leave their biases at the door.

Book a call now.

share to